All Eyes Remain on the Fed and Inflation

The market’s focus on Federal Reserve policy remains unchanged as stubbornly high inflation forces the Fed to raise interest rates and shrink its balance sheet. The Fed’s aggressive tightening actions are increasing market volatility and causing stock and bond prices to trade lower. The S&P 500 is now in a bear market, defined as a -20% decline from recent highs, and interest rates are rising to multi-year highs. The 2-year Treasury yield recently rose to its highest level since 2007 as investors bet that 40-year high inflation will push the Fed to be more aggressive.

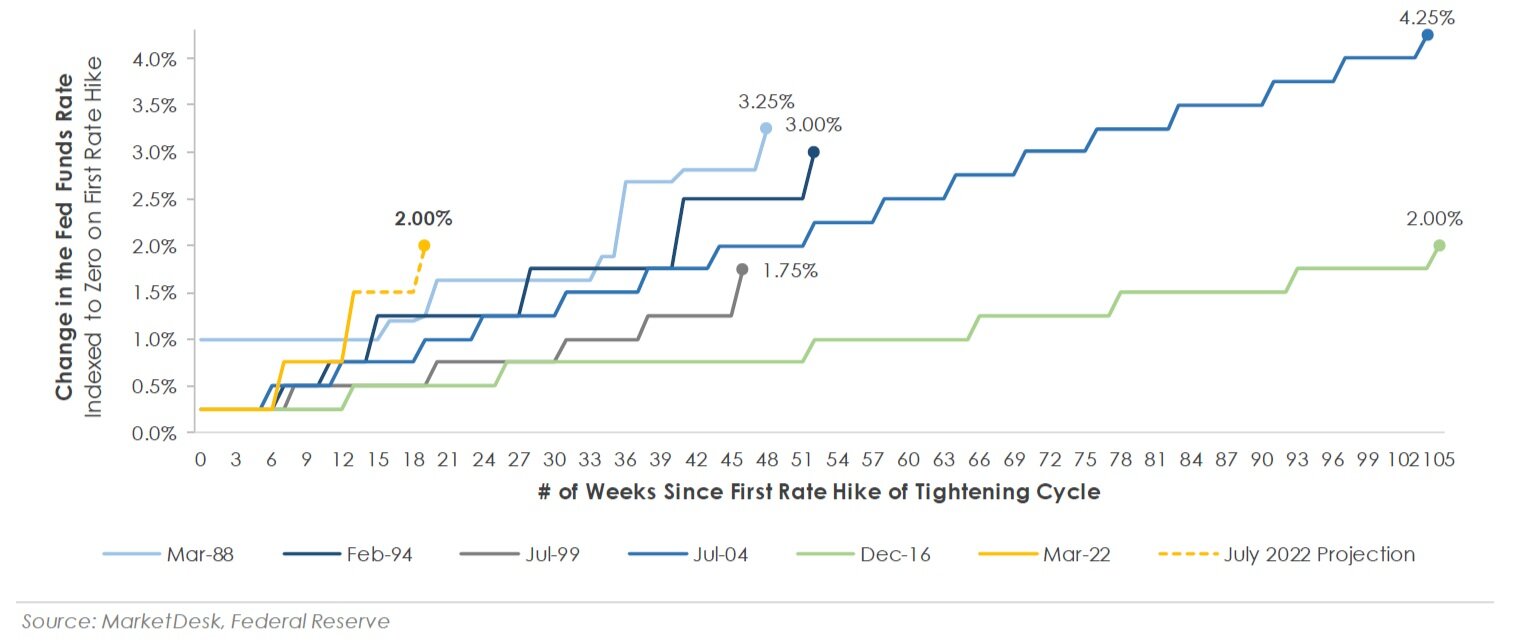

How does this tightening cycle compare to prior cycles? The most notable difference is the speed and size of the interest rate increases. Figure 1 compares the current cycle’s fed funds rate path against the last five cycles. Factoring in the +0.75% increase at this week’s June meeting, the Fed has raised interest rates +1.50% since the first increase in March. Investors expect the Fed to return to its +0.50% pace at the July meeting, making 2022 the fastest +2.00% increase compared to the last five cycles. The Fed is expected to keep raising interest rates at its meetings later this year, although the increase amount remains an open question.

Comparing Fed Funds Rate Movement Across Tightening Cycles

The chart shows the current Fed tightening cycle has more in common with the 1988 and 1994 cycles than the post-2000 cycles. It’s a market environment investors haven’t experienced in a long time. The Fed’s aggressive actions are driven by widespread price pressures across food, energy, housing, airfares, vehicles, etc. This raises a particularly concerning risk – persistently high inflation could provoke the Fed to tighten too much and negatively impact economic growth. High inflation could become entrenched, as well as significant uncertainty about how high and fast the Fed will need to raise interest rates to contain inflation. The result is a market trying to navigate uncharted waters.