How will the Market Respond to Fed Tightening?

We will likely experience the volatility felt in the first quarter into the middle of this calendar year. The slight rally in the late part of March can be attributed to a slight easing of geopolitical tensions and the expectation of rising inflation. The expected rise in inflation causes investors to generally opt for more risky assets in search of positive after-inflation returns. Regardless, our overall outlook has not changed in that the Fed is aggressively tightening, and we are entering the late cycle.

We have been watching private markets with limited liquidity, such as venture capital, private equity and credit, and real estate. The Fed's March FOMC meeting minutes reconfirmed officials are focused on easing inflation pressures, and meeting minutes signal this tightening cycle will be materially faster than the 2016-2018 cycle.

Our view is that private markets with limited liquidity are the most significant risk to the public equity market. The Fed tightening monetary policy, raising rates, and shrinking its balance sheet point to the desire to curb demand and limit risk-taking. Chipping away at liquidity will be an adverse consequence. Notable private equity players such as Softbank and Tiger Global are already dealing with the repercussions, struggling due to the markdown of private assets. Both firms and many others experienced great boosts due to the ultra-easy monetary policy that had been in place previously.

Across the rest of the economy, this is happening on a smaller scale. Everyone from small-time real estate investors, personal homebuyers and entrepreneurs who took advantage of market conditions where demand was high are all feeling the effects of this policy. The Fed enabled the majority of the risk-taking, and now it needs to curb the risk-taking to put the economy on a stronger footing. There will need to be more markdowns in private markets.

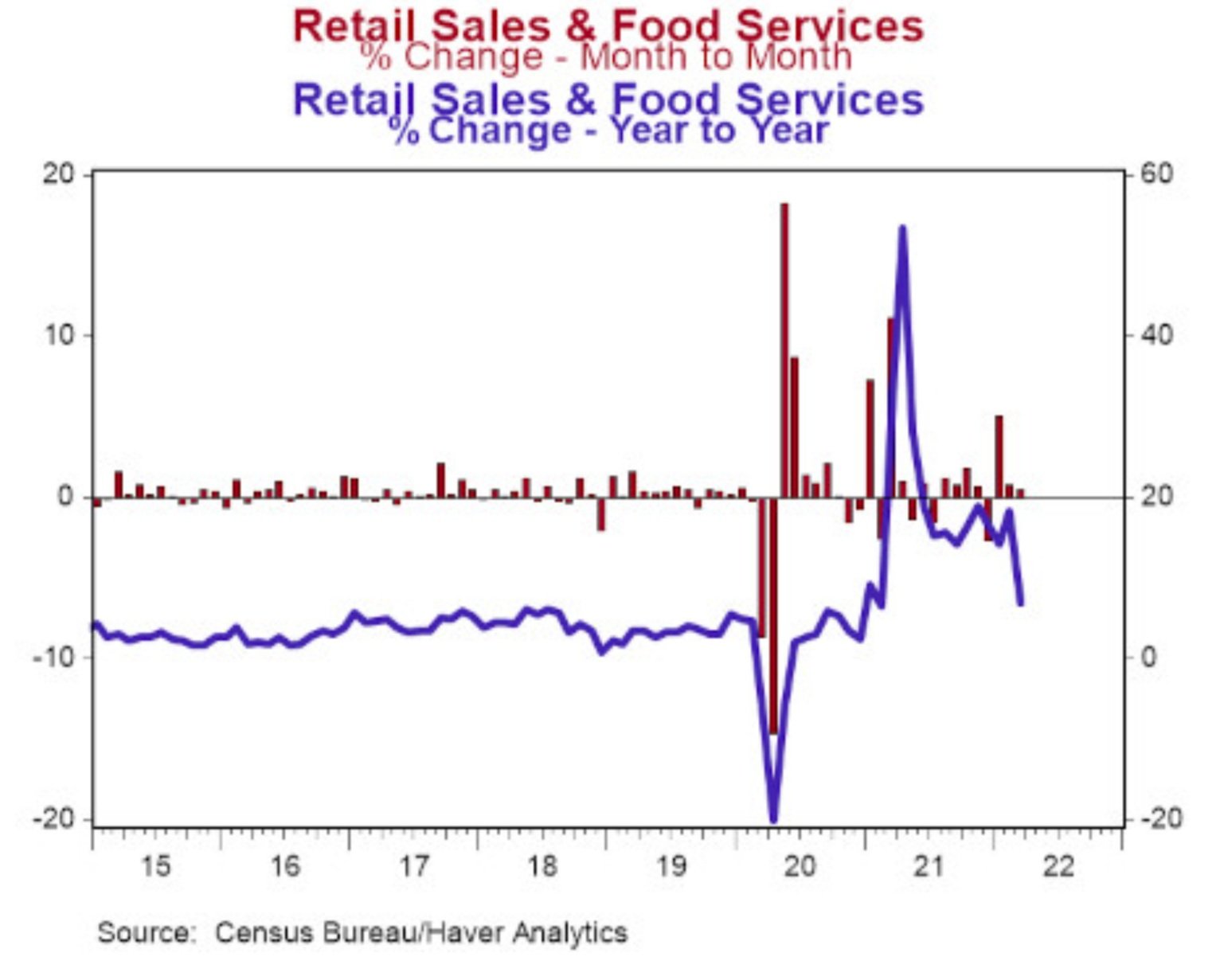

Retail Sales and Food Services - Month to Month vs. Year to Year % Change

Times like these are where liquidity, or the lack thereof, comes into play. Public markets offer more liquidity than private markets, which means investors will turn to their public equity portfolios to raise cash. If asset owners become forced sellers to raise cash, they will sell their most liquid assets rather than selecting assets based on fundamentals. It is a significant risk for public markets and is yet another reason to play defensive and not chase risk in the current macro environment.

Inflation remains stubbornly high. The Personal Consumption Expenditures (PCE) Index, which reflects the changes in the prices of goods and services purchased by consumers in the United States and is considered a key gauge of inflation by the central bank, jumped 6.4% on a 12-month basis in February.

US Stock Market Returns During Period of Positive and Negative Earnings Growth

Source: Invesco 4/22

Historically, investors have been amply rewarded by simply sticking to stocks in periods when earnings growth was positive, as it is now. While we believe stocks remain the place to be amidst a moderating economy, peak earnings growth should compel investors to lower their expectations for absolute returns. In other words, we expect stocks to continue doing well in 2022, just probably not as well as they did in 2021 and 2020.