US Manufacturing Forecast Declines

Lower PMI Levels Forecasted During 4Q22

The projected Manufacturing PMI decline supports a cautious, risk-off approach to financial markets during 4Q22 and 1Q23. Our research provider, MarketDesk, projects PMIs will approach 50 during the next three months before dipping below 50 (i.e., manufacturing contraction) during 1Q23. A downward trending PMI doesn't necessarily indicate the market will trade off aggressively, but it points to an unattractive risk/reward setup with below-average and potentially negative returns.

What is PMI?

The ISM Manufacturing Purchasing Manager Index (PMI) is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It indicates the level of demand for products by measuring the amount of ordering activity at the nation's factories. The updated PMI number is announced on the first business day of each month. A PMI above (below) 50 indicates an expansion (contraction) of the manufacturing segment of the economy compared to the previous month. A reading of 50 means no change.

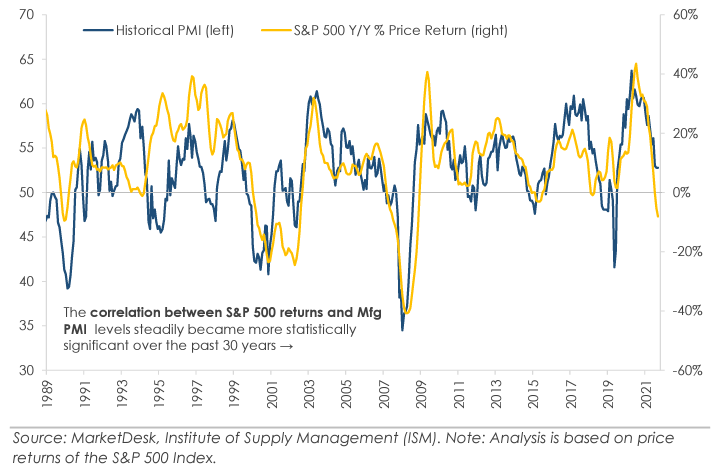

ISM Manufacturing PMI vs Rolling 12-Month S&P 500 Price Return

Why Are PMI Levels Important

The chart above compares the ISM Manufacturing PMI vs the S&P 500 rolling 12-month price return. It shows that the S&P 500's returns moved in line with the ISM Manufacturing PMI over the past two decades. A rising PMI indicates the manufacturing segment of the economy is expanding, which historically points to positive forward equity returns. In contrast, a falling PMI indicates the manufacturing segment of the economy is contracting.

The relationship has steadily strengthened as more investors incorporate PMI readings into their asset allocation decisions. Since 1990, there has been a 0.77 correlation between the ISM Manufacturing PMI and S&P 500 price returns.

Actionable Advice

We remain optimistic about the US stock market based on the medium-term technical trends we follow. The trends show the US stock market is in better shape than it was at the start of the summer.

Given the current recession, we favor a value sector weight approach vs. a growth stance. Historically, stocks paying dividends and having a reasonable price-earnings ratio have performed better in a recessionary environment.

We are watching two dominant themes, inflation and Fed policy, which are in the driver's seat for this market. Inflation remains the most critical data point to watch, and this week's data highlights inflation's persistence.

Therefore, investors need to review their holdings, put a defensive plan in place, and consider tax-harvesting positions in their portfolios that are technically weak. This advice would especially be true of portfolio holdings that have continued to show technical weakness this summer, including an uptrend for the market.