Contact Me

My name is Alex Pehar and I work with businesses on their retirement plans.

As a fiduciary advisor and 3(38) investment manager, plan sponsors leverage my expertise when it comes to plan design, investments, and finding service providers that are a perfect fit.

If you are not fully satisfied with your current retirement plan or you don’t know where your plan is competitive, give me a call at my direct line: (480) 378-6002.

If there is a way to reduce your costs, reduce your headaches, or increase performance, I will find it.

Statistics

632+ plans benchmarked and counting

Over 100M in Assets Under Management

Over 50 complimentary consultations completed this year

Book an appointment

Let’s get a solution for you—anything 401(k) or wealth management related.

A Retirement Plan That Works For You

As a fee-only independent fiduciary with over 30 years of investment experience, our team has the knowledge and capability to create the 401k plan your employees deserve.

It is our fiduciary duty to exceed our clients’ expectations: upholding rigorous standards when it comes to investment performance, service, and cost.

We save businesses time, energy, and money while providing a world-class retirement plan for employees.

Some Of Our Partners

To assist organizations ready to explore their options, we create fully-tailored proposals. With your input, we will work to craft a complete, itemized proposal of everything needed to transition.

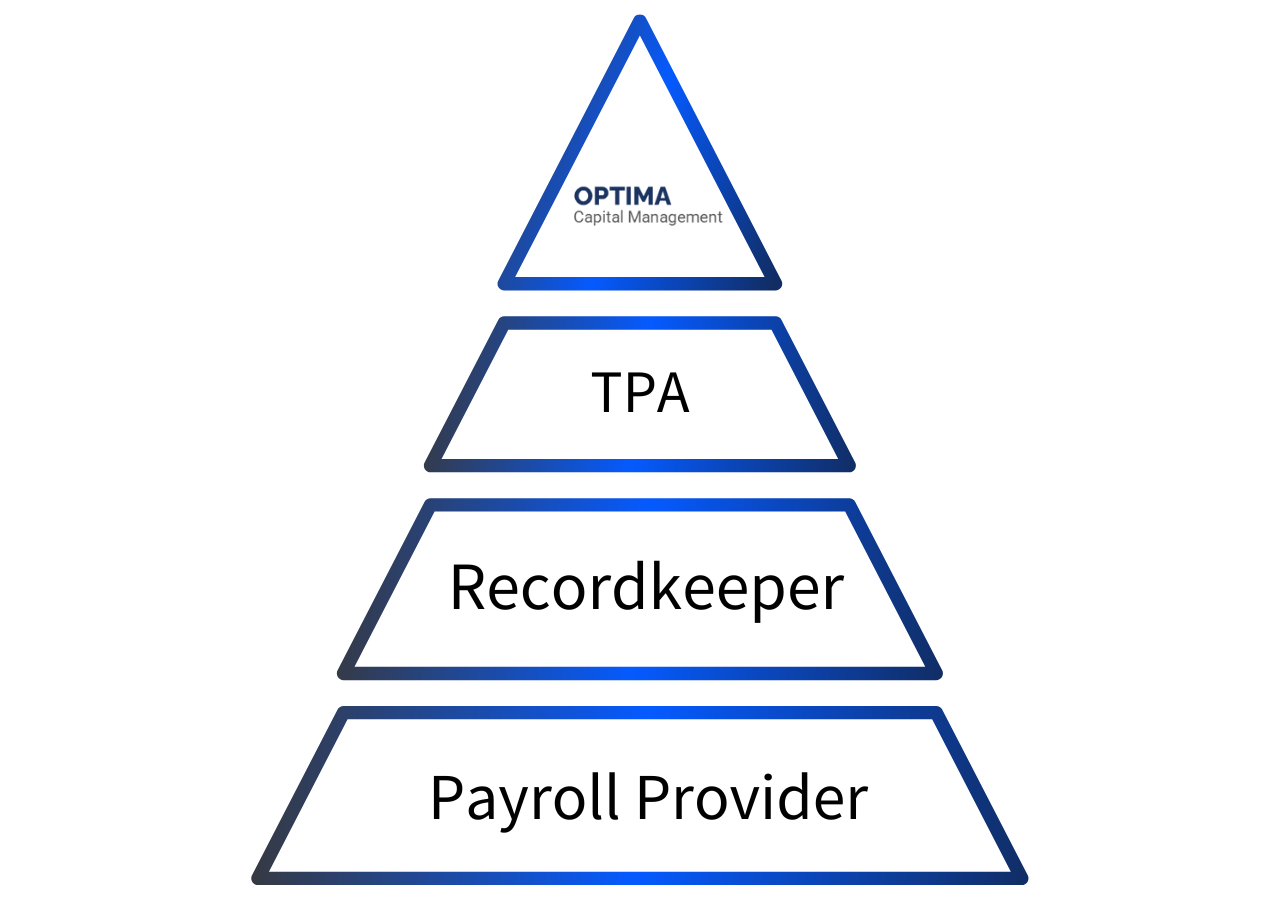

Seamless Integration

As an advisor and fiduciary investment manager, we integrate seamlessly with your current payroll provider, recordkeeper, and TPA.

Reduce Administration Costs

Businesses leverage us to find the best fit when it comes to payroll, recordkeeping, and administrative costs. Below are some of the costs we’ve helped clients streamline:

Payroll integration

Recordkeeping

3(16) Costs

Advisory Costs

Investment Expense Ratios

Plan-Level Investment Services

Our investment approach combines fiduciary-based advice, independent research, and rules-based processes incorporating fundamental and technical factors. This approach allows us to function as portfolio managers, making decisions per your preferences and providing accountability and transparency on the following services:

Portfolio Models

We will construct asset allocation models consistent with your investment policy statement. Our models can include a range of portfolios from conservative to growth to fit your employeeʼs needs and time horizon.

Investment Monitoring and Reporting

We will assist you as the Plan Sponsor in regularly analyzing the overall performance of the Planʼs investments. We will review the investment options continuously and recommend changes, as necessary, including recommendations to remove or replace any underperforming investment options.

Investment Policy Statement (“IPS”)

We will review, evaluate, and, if necessary, work with your Planʼs custodian or record keeper to create or revise the IPS for Plan adoption.

Investment Menu Design

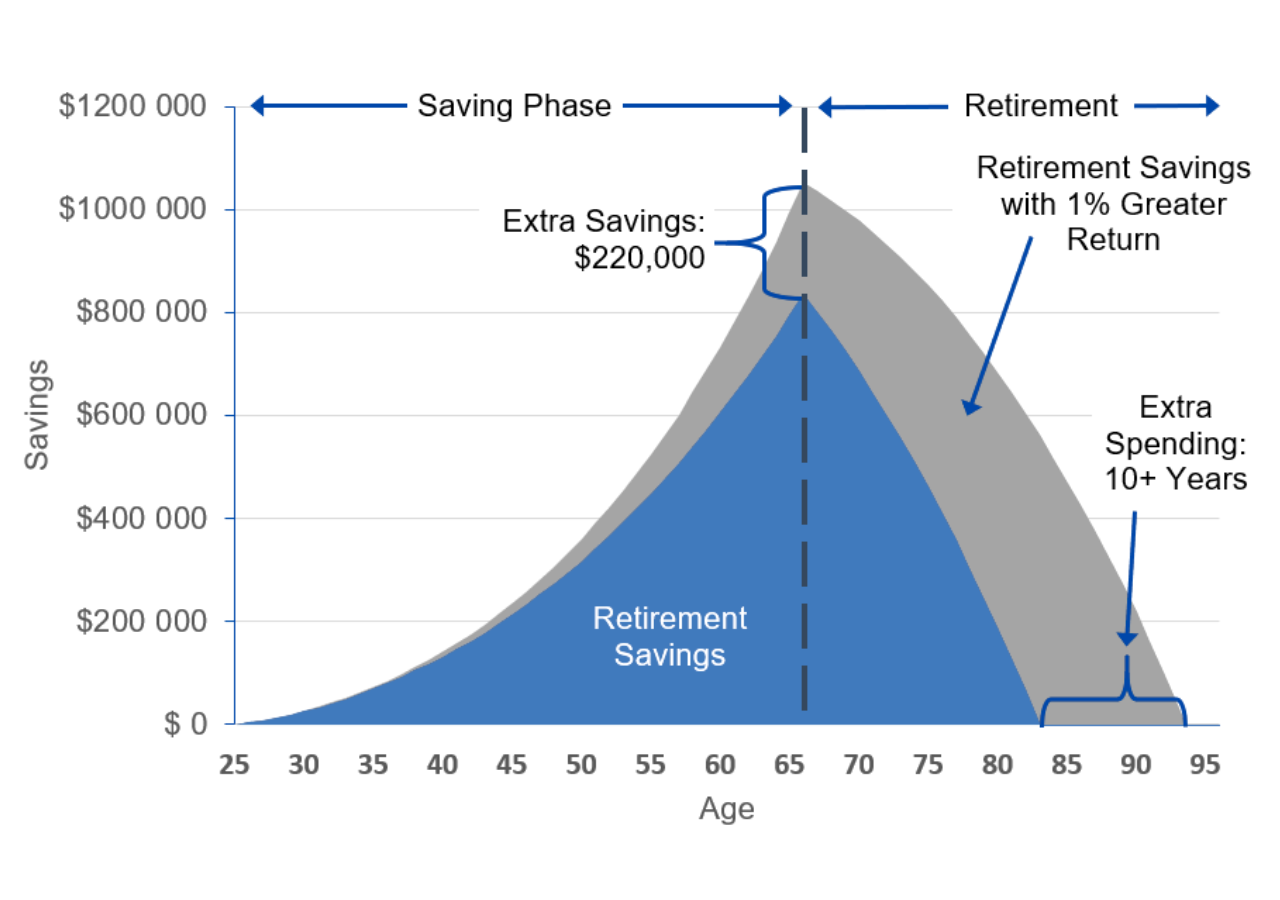

Our team will design an investment menu with a broad and diversified range of asset classes and investment categories of an appropriate size for the Planʼs participants. Additionally, we will guide you as the Plan Sponsor or Investment Committee on obtaining investment options at a reasonable cost to improve your planʼs cost efficiency. Lower-cost investment choices can help your employees improve their investment return over the long term.

Participant-Level Services

We prioritize the success of participants above all else

Investment Advice

Your employees will have access to our team of financial professionals who can provide investment recommendations based on investment objectives, risk tolerance, time horizon, and other preferences to recommend a suitable asset allocation model

Financial Education and Wellness

We want your employees to feel confident about where they stand on achieving their retirement goals. With our tools, resources, and financial education, your employees will have a roadmap to achieve their financial goals

Self-Directed Brokerage Accounts (SDBA)

Plan participants may be able to use a self-directed brokerage account (SDBA), which can complement the core model investment portfolios. A self-directed brokerage account gives participants greater access to thousands of additional investment choices.

Fiduciary Guidance

The Employee Retirement Income Security Act of 1974 (ERISA) requires business owners to follow specific rules in managing retirement plans. Employers are held to a high standard of care and diligence and must discharge their duties solely in the interest of the plan participants and their beneficiaries.

To help with your ERISA responsibilities, we will provide periodic education to you as the Plan Sponsor or the Plan committee on current topics.

3(38) & 3(21) Investment Management

Optima Capital serves as a co-fiduciary investment adviser with the Plan Sponsor.

We have developed a proprietary process for selecting and managing over 34,000 available investments. Operating on a relative strength system, we aim to include funds in the top quartile of performance respectively.

Plan Evaluation

Our team will help you, the Plan Sponsor, assess the plan benefit design and make recommendations to improve the planʼs overall effectiveness as a retirement savings vehicle for Plan participants.

We will assist the Plan Sponsor with selecting a recordkeeper, third-party administrator, and a qualified custodian as Plan trustee. Finally, we can help assess and review progress for goals established concerning Plan participation and participant contributions.