Arrival of and Resulting Conditions From Low Fed Rates

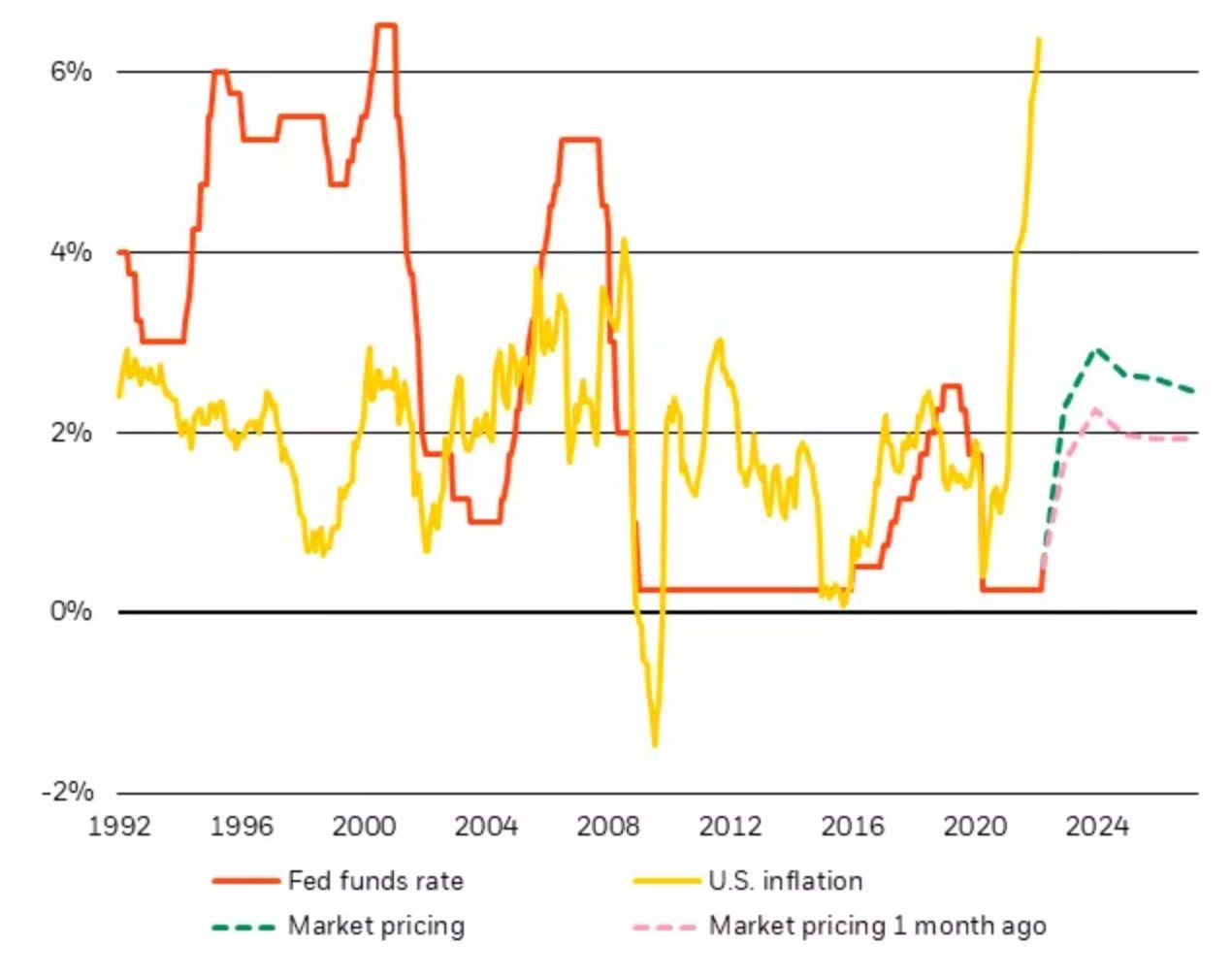

The yield on the 10 Yr U.S. Treasury hit a three-year high after data showed inflation was running at levels not seen since the 1980s. These high yields created a feeling of apprehension surrounding the equity markets. Of the greatest concern for many are the stocks of fast-growing tech companies because higher discount rates make future cash flows less attractive. That being said, our view is that fears of a monumental falloff in the equity market are largely exhausted. The expected rate hikes are coming faster than forecasted; however, we do not see central banks raising rates further beyond neutral levels. The chart below from Blackrock shows that the markets are priced right now to include a rapid rise of the fed funds rate (up to 3% in the next year, followed by a leveling out to 2.5% in 5 years’ time), which is represented by the green line on the chart. That is markedly higher than a month ago (dotted pink line), just before the Fed raised rates and started to talk tough on inflation. We do not see the Fed raising rates this high. Even if it did, the level would still be historically low compared with previous hiking cycles (red line) and the level of inflation (yellow line).

Fed Funds Rate and US Inflation, 1992-2027

In our view, it is the sum total of rate hikes that matters in terms of the future value of equities, as opposed to simply timing and speed. We employ the cumulative rate in estimating future cash flows of a corporation, not the current rate or bond yields. This means that the higher the peak rate is during this cycle, the bigger the impact will be, due to its compounding effect over time. Because of this, we believe equities can thrive when the final resting place of policy rates is historically low. Central banks will be forced to live with inflation as a part of a course of action to avoid destroying economic growth and employment.

It is likely that inflation will settle higher than pre-Covid levels. This comes at the heels of supply shocks associated with the restart of economic activity, as well as the geopolitical impact of the war in Ukraine. The effect of this would be seen in real yields (adjusted for inflation) remaining low. Long-term yields may rise further as investors create demand for increased compensation for holding them through the inflationary period.

One of the small number of things that stand out at the beginning of the second quarter of 2022 is the powerful restart in the economy, which is providing a safety net for growth in developed markets, notably in the US. So far, companies in these developed markets have been able to shield themselves from increased input costs by passing them on to the customer, as well as keeping labor costs in check. Whether this continues is to be seen.

Additionally, record-high profit margins of companies are something we will continue to monitor. The Ukraine war has cut into earnings even as analysts constantly revise estimates. We expect that estimates for European companies, in particular, will see adverse effects as analysts continue to factor in the impact of the war. The unfortunate good news, for the U.S., is that a weaker euro means likely a stronger dollar.