Is Recent Inflation Indicative of an Upcoming Recession?

There is little relief in sight on the inflation front. March's Consumer and Producer Price Indexes jumped 8.5% and 11.2% year over year. Rising prices for food and energy commodities were primarily behind the cost surge.

The stubbornly high inflation brings more-hawkish monetary policy comments from Federal Reserve leaders. The consensus is that the central bank will hike the benchmark short-term interest rate by 50 basis points at next month's Federal Open Market Committee (FOMC) meeting, which may be the first of a few half-percentage-point increases this year.

Recent commentary has also raised the odds that the Federal Reserve Bank will begin to reduce its balance sheet aggressively, perhaps as early as the May FOMC meeting. Such a reduction–selling bond holdings or allowing them to mature–would remove excess liquidity from the financial system, contributing to inflation. Its asset holdings swelled to nearly $9 trillion following the massive stimulus programs implemented to support the U.S. economy during the height of the COVID-19 pandemic.

Meantime, rising Treasury market yields have caught the attention of Wall Street. The yield on 10-year Treasury notes, used as a proxy for mortgage rates, recently topped the 2.80% mark. That is more than 100 basis points (an entire percentage point) higher than where it sat on March 1st. The resultant higher borrowing costs may ultimately slow the pace of economic expansion.

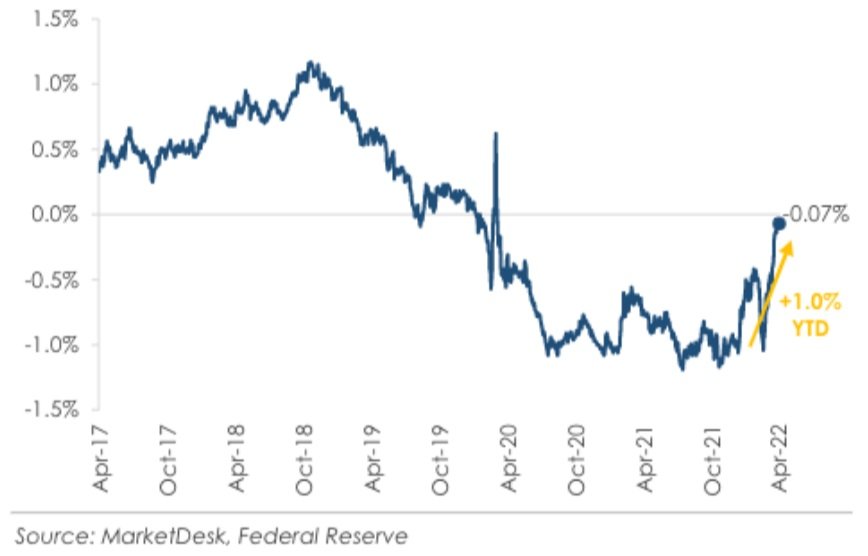

As 10-Year US Treasury Yield Reaches a 3-Year High

An inverted yield curve has been a relatively reliable predictor of a future recession. The early April inversion of the Treasury market yield curve–the yield on the two-year note exceeded that of the longer duration 10-year bond–has raised some red flags about the U.S. economy. The central bank must guard against slowing demand too much, risking "stagflation," a period of high inflation, and slowing economic growth (stagnation), accompanied by rising unemployment. Recession fears may make the Fed's task of stabilizing prices harder, as painfully higher interest rates fight inflation underpinned by supply constraints.

10-Year US Treasury Yield Nears Positive Territory

Concerns about a more hawkish Fed and falling bond prices are priced into the market. We believe these market conditions call for a portfolio mainly of well-diversified, high-quality equities. A portfolio of mostly high-quality equities serves the investor well to fare the choppy waters of the near-term market.