Hot Inflation Report Sends Stocks & Bonds Trading Lower

Photo Credit: Benjamin DeYoung, Unsplash

Weekly Market Recap for April 13, 2024

This week, the BLS reported that the Consumer Price Index (CPI) gained 0.4% on a monthly basis, which was stronger than what investors had anticipated and on par with the prior read. The CPI was up 3.5% year over year, above expectations and the February rate. The core CPI, ex-food, and energy prices advanced 0.4% and 3.8%, month on month and year on year, respectively, ahead of estimates and steady with February’s pace. Investors are concerned that with inflation proving resilient, the Fed might decide to implement fewer rate cuts than hoped for and later this year than expected. The consensus on Wall Street is that the Fed may only reduce interest rates in one or two increments (25 basis points each) in the second half of this year, perhaps not starting until July. The central bank’s ultimate course of action will depend on incoming data.

S&P 500 Index (Last 12 Months)

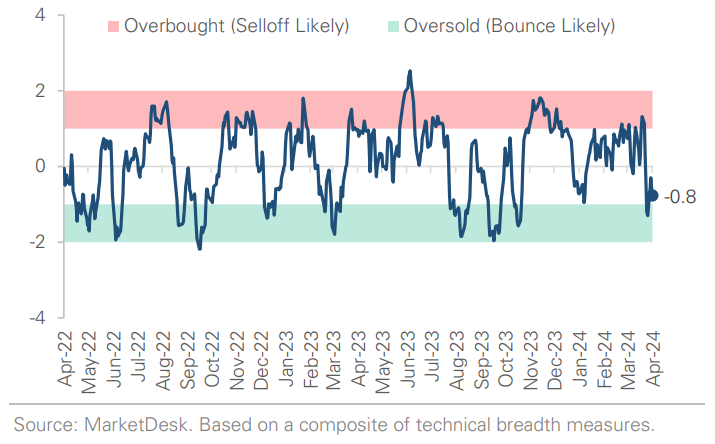

S&P 500 Technical Composite (Last 24 Months)

Inflation

This week's CPI report showed that inflation accelerated during March, which caught the market offside. The market's immaculate disinflation thesis always struck us as odd, considering that investors knew the last mile of getting back to 2% would be challenging. The latest inflation report confirms the difficulty. There are multiple ways to interpret the release, but two stand out. First, the disinflation process has slowed.

The chart below shows the change in not seasonally adjusted inflation (i.e., raw price increases) against the same month one year ago. A positive number indicates that raw/unadjusted inflation was higher than the same month a year ago, while a negative number suggests lower inflation. The chart also shows the steady disinflation progress from October 2022 through 3Q23. However, progress started to slow in 4Q23 and is now being undone.

Second, the Atlanta Fed's sticky vs flexible CPI tracker shows categories with infrequent price adjustments continue to exhibit elevated inflation. Previously, the Fed could sit back, let the deflationary impulses work through the economy, and benefit from the base effect (i.e., easy comps). Now, the hard work starts, which has two implications for monetary policy: (1) fewer rate cuts and (2) a prolonged period of QT. We expect inflation to grind lower, but the Fed needs to stop promising rate cuts, which makes its job more difficult by prematurely loosening financial conditions.

The Disinflation Process is Slowing

Sticky CPI Categories Highlight Inflation’s Persistence

Market Liquidity

There has been a surge in market liquidity during the past six months. It also highlighted the lower reversal in our Net U.S. Liquidity Indicator, which peaked on February 16th. As mentioned, our base case is that market liquidity will deteriorate during Q2 due to a combination of factors. First, the April 15th tax deadline is Monday. We expect individuals to owe tax this year due to strong 2023 market returns (i.e., capital gains & interest income) and high nominal GDP growth (i.e., higher personal income = more tax due). The money to pay those tax bills is likely to come from either bank accounts or financial markets and go into the Treasury’s general account, thereby decreasing liquidity. Second, the Fed’s reverse repo program (RRP) currently sits at $450 billion, down from over $2 trillion in mid2023. As a reminder, RRP is a catch-all for excess liquidity in the market that wants to earn a cash-like yield. The decline in RRP means there is now less excess liquidity that can flow into financial markets, which removes a key source of liquidity.

Investor Sentiment

Our US Investment Sentiment Indicator currently sits at 95%. The sentiment indicator bottomed at 7% the week of October 23rd and has trended chiefly higher during the past six months. It recently rose above 90% for the first time in more than two years. A lot of optimism is currently priced into the market, which has implications for forward returns. The chart below shows that the S&P 500's forward returns tend to be below average, with a lower win rate when the indicator reads above 90%. In addition, the weakness becomes more pronounced over longer timeframes (i.e., six months and longer). Investor sentiment is not a reason to turn negative on the market, but it leaves the market vulnerable to a sudden shift in sentiment, such as this week's inflation report.

US Investor Sentiment Tops 90%

Historical Forward S&P 500 Returns

Q2 Market Implications

Deteriorating liquidity and optimistic sentiment change the range of potential market outcomes. First, the equity market tends to experience more volatility and bigger drawdowns as liquidity deteriorates. Second, sentiment readings above 90% historically signal below-average returns and lower win rates. For those making allocations based on probabilities, the indicators signal the potential for less upside and more downside during Q2.

Asset Small Business Sentiment Remains Weak

The NFIB small business optimism index fell to 88.5 in March. It was the third consecutive monthly decline, the 7th decline in the last eight months, and the lowest reading since December 2012. Inflation remains the biggest problem facing small businesses as owners manage higher prices and interest rates. Business owners are also concerned about softer demand, with a higher percentage of owners forecasting lower real sales volumes. The depressed small business sentiment contrasts starkly with data signaling a firmer U.S. growth backdrop, such as March's +303,000 job gains and the ISM Mfg PMI's recent climb above 50 for the first time since September 2022. Financial conditions remain relatively easy for large companies, but tighter financial conditions constrain small businesses.

Small Business Optimism Drops to 11-Year Low

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.