1Q 2024 Recap and 2024 Outlook

Photo Credit: Eilis Garvey, Unsplash

Key Updates on the Economy and Markets

Stocks continued their upward trajectory in early 2024. The S&P 500 returned more than 10% for a second consecutive quarter, setting multiple new all-time highs. Notably, this quarter saw a significant shift in sentiment, as investors now expect only three interest rate cuts this year compared to six at the start of the year. This expectation change came as inflation progress slowed and the US economy continued to expand despite higher interest rates, both of which signal a need for fewer rate cuts. This letter recaps the first quarter, discusses the stock market’s strong start to 2024, and looks ahead to the second quarter.

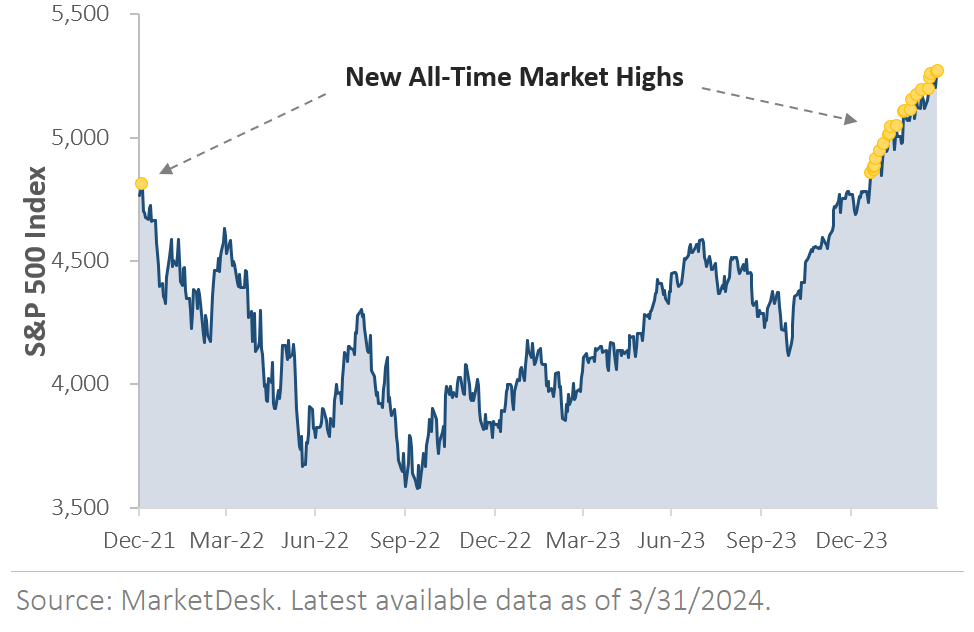

S&P 500 Sets New All-Time Highs in Q1

The stock market is off to a strong start this year, with the S&P 500 Index gaining +10.4% in the first quarter. Figure 1 graphs the price of the S&P 500 Index since the end of 2021. The yellow dots mark new all-time closing highs. On the far-left side of the chart, the single yellow dot marks the previous all-time closing high set on January 3rd, 2022. Shortly after the January 2022 all-time high, the Federal Reserve started its aggressive interest rate hike campaign as inflation spiked to a 40-year high. The chart shows the 2022 stock market selloff as investors feared higher interest rates would slow the economy.

S&P 500 Index Sets Multiple New Highs in Q1

The question is whether the slowing progress is the start of a new trend or a temporary break in the current trend. Seasonality may contribute to the slowdown, as inflation tends to be higher earlier in the year and lower later in the year. Is the early 2024 rise resulting from previously agreed-upon contractual price increases, or does it hint at something more under the surface? Federal Reserve Chair Jerome Powell believes the early 2024 inflation bump is seasonal and short-term. The market is less certain and more divided.

The chart also demonstrates that returning to the Fed’s 2% inflation target will be bumpy and uneven. The disinflation process will not be a straight line. The latest risk is rising oil prices, with the price of a regular gallon of gasoline jumping by over +20% during Q1. Falling energy prices helped to ease inflation pressures during the past two years, but there is now a question about whether that trend can continue with gas prices rising.

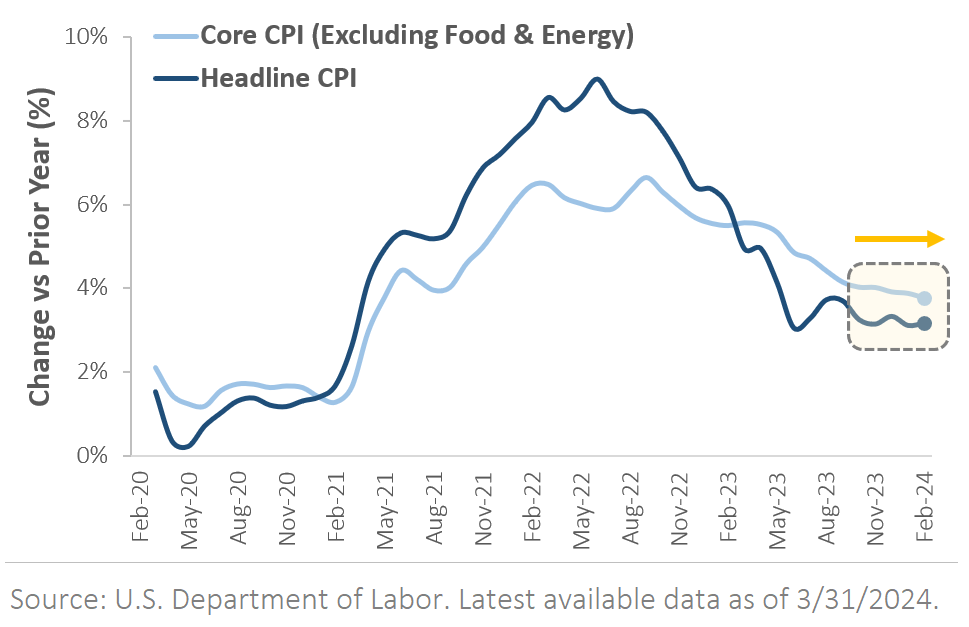

Inflation Progress Slowed in Q1

Inflation was on a steady downward trend heading into this year, and the market expected it to continue moving lower. However, recent data is causing investors to rethink that assumption. The graph below shows the year-over-year change in the Consumer Price Index, which measures the change in price for a basket of consumer goods. The chart shows the inflation spike in 2021 and early 2022, followed by easing inflation during the past two years. However, the yellow box shows that the pace of inflation progress has slowed recently. While inflation is drifting lower, it is not falling as quickly as investors or the Federal Reserve want.

Headline and Core Consumer Price Index (CPI)

The question is whether the slowing progress is the start of a new trend or a temporary break in the current trend. Seasonality may contribute to the slowdown, as inflation tends to be higher earlier in the year and lower later in the year. Is the early 2024 rise resulting from previously agreed-upon contractual price increases, or does it hint at something more under the surface? Federal Reserve Chair Jerome Powell believes the early 2024 inflation bump is seasonal and short-term. The market is less certain and more divided.

The chart also demonstrates that returning to the Fed’s 2% inflation target will be bumpy and uneven. The disinflation process will not be a straight line. The latest risk is rising oil prices, with the price of a regular gallon of gasoline jumping by over +20% during Q1. Falling energy prices helped to ease inflation pressures during the past two years, but there is now a question about whether that trend can continue with gas prices rising.

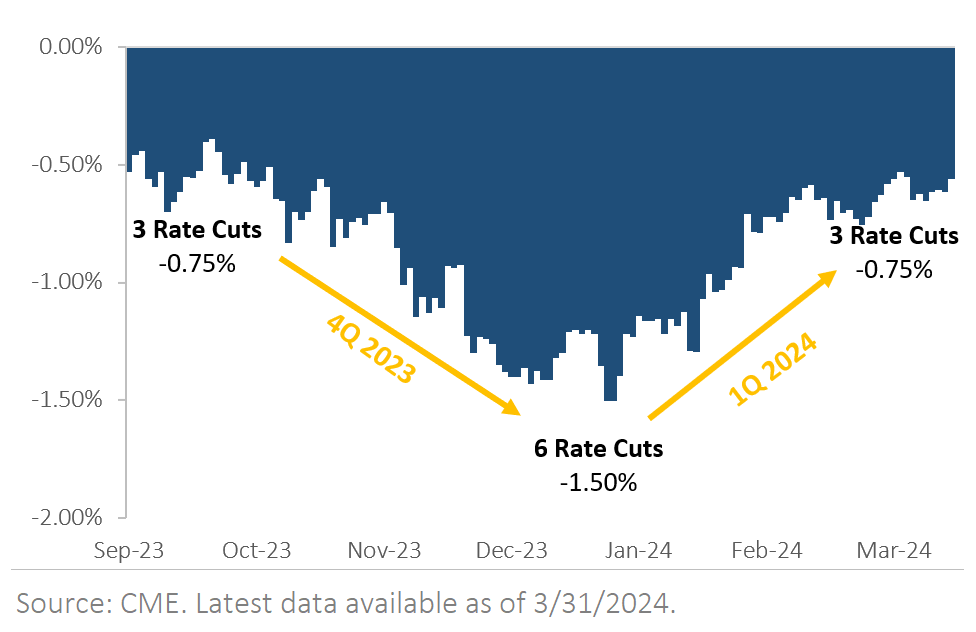

Investors Expect Fewer Interest Rate Cuts This Year

One of the big debates heading into 2024 was how often the Federal Reserve would cut interest rates. Figure 3 tracks the market’s rate cut forecast. Looking back to the start of Q4 2023, the market expected the Federal Reserve to cut interest rates by -0.75% this year. By the end of December, the market’s rate cut forecast for the entirety of 2024 had risen to -1.50%. Based on a typical rate cut increment of -0.25%, investors came into this year expecting six interest rate cuts (i.e., -1.50% in total cuts).

In contrast, the Federal Reserve only expected three interest rate cuts at the start of this year or half the market’s estimate. There was a debate over whose interest rate cut forecast was more accurate. As of the end of Q1, the central bank’s forecast appears more accurate. Investors now only expect three interest rate cuts this year, which aligns with the Fed’s initial forecast.

Investor’s Forecasted Rate Cuts in 2024

Why do investors expect fewer interest rate cuts this year?

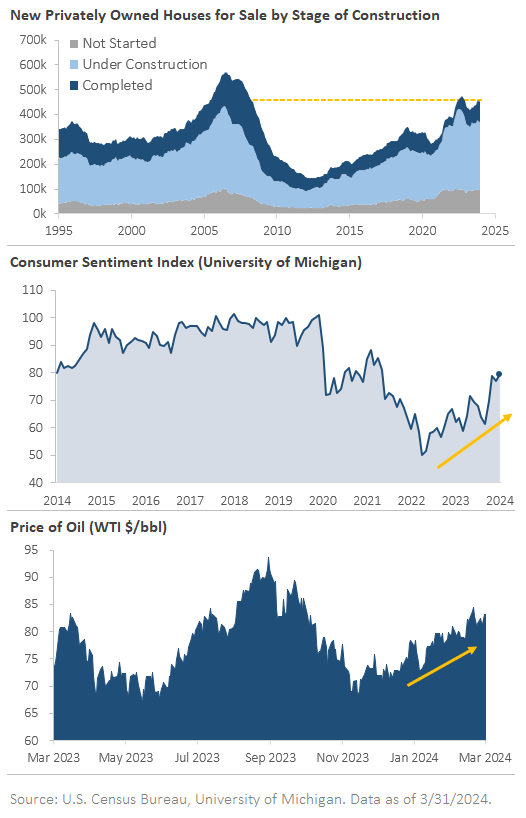

One reason is that inflation progress is slowing. Another reason is that the US economy remains resilient despite higher rates. The chart below shows three data points that underscore this resilience. The top chart graphs the number of new homes for sale by stage of construction: not started, under construction, and completed. The chart shows home construction activity is at levels not seen since before the 2008 financial crisis, despite the average 30-year fixed-rate mortgage sitting near a 15-year high of 7%.

The Middle section shows consumer sentiment rose to a 2.5-year high in March after setting a record low in June 2022. Multiple factors are contributing to the improved sentiment, including a tight labor market, rising stock prices and home values, expectations for a continued decline in inflation, and a solid economic backdrop.

The bottom chart tracks the price of a barrel of West Text Intermediate crude. Crude oil prices have risen from approximately $70 per barrel at the start of the year to $83 per barrel at the end of Q1, an increase of roughly +18.5%. Oil is a cyclical commodity, so rising oil prices suggest demand is strong and may hint at underlying strength in the US economy.

Data Highlights the US Economy’s Resilience

Equity Market Recap - Stocks Post a Second Consecutive Quarter of Strong Gain

The opening section discussed the stock market’s strong start to the year. Following an impressive +11.6% gain in Q4, the S&P 500 returned +10.4% in Q1. Small-cap stocks underperformed during the quarter, as the Russell 2000 Index returned +5.0%. Ten of the eleven S&P 500 sectors posted gains, with cyclical sectors outperforming their defensive counterparts. The energy, financial, and industrial sectors outperformed the broader S&P 500 Index, while the real estate, utility, and consumer staple sectors underperformed as the stock market rallied.

International stocks underperformed US stocks for a fourth consecutive quarter during Q1. Over the past twelve months, the MSCI EAFE Index of developed market stocks has returned +14.8% or roughly half of the S&P 500’s +29.4% return. The MSCI Emerging Market Index has returned only +6.8% or approximately one-fourth of the S&P 500. A few themes may explain why international stocks continue to underperform. First, international stock market indices lack exposure to leading artificial intelligence companies like Microsoft, Nvidia, and Super Micro Computer. Second, as discussed above, the US economy continues to expand despite higher rates. In contrast, some countries and regions outside the US already feel the impact of higher interest rates. Investors have been attracted to the US for its AI exposure and relative economic strength.

2024 Q1 US Stock Market Sector Returns %

What does the financial landscape look like today? Following the Q4 rally, multiple major stock market indices are trading near all-time highs. The market charts below show the prices of three broad stock market indices: the S&P 500, the NASDAQ 100, and the Dow Jones. The S&P 500 is hovering near its January 2022 all-time high, while the NASDAQ 100 and Dow Jones made new all-time highs in December. Year-to-date, the S&P 500 returned +26% in 2023, and the Russell 2000 returned +16.7%. The NASDAQ 100 soared +54.7%, its biggest year since 1999. Along the way, stocks defied higher interest rates, geopolitical tensions, and multiple US regional bank failures to record solid gains.

Credit Market Recap – Bonds Rally as Yields Fall

While stocks started the year with strong gains, bonds traded lower during Q1. The losses came as investors realized that the continued resilience of the US economy meant the Federal Reserve might not need to cut interest rates as much, which caused Treasury yields to rise. The Bloomberg US Bond Aggregate Index, which tracks a broad index of investment-grade rated bonds, posted a total return of -0.7%. It was a sharp reversal from Q4 when the index posted its first quarterly gain since Q1 2023 and its biggest quarterly gain since 1989.

In the corporate bond category, investment-grade bonds underperformed high-yield bonds during Q1. Over the past twelve months, high-yield corporate bonds have generated a total return of +8.8%, a factor in the interest payments received. Investment-grade corporate bonds generated a +3.5% total return over the same period. The high-yield bond universe continues to benefit from multiple themes. First, the group yields 7.83% at the end of Q1, which is 2.45% higher than investment-grade bonds. This extra yield helps boost high-yield’s total return. Second, the US economy has remained resilient despite higher interest rates. With the US economy expanding steadily, high-yield bonds’ credit risk has remained stable, limiting the number of defaults.

2024 Outlook - Themes to Watch

The significant investment themes were mainly unchanged during the first quarter. Stocks continued trading higher, and the US economy remained expanding. While the market now expects fewer interest rate cuts this year, the primary reason is that investors and the Fed believe the US economy can handle higher interest rates. Economic theory suggests that higher interest rates should slow economic activity as the cost of capital increases, but the data tells a different story this cycle. Home construction activity has been the strongest since before 2008. Consumer sentiment recently hit a 2.5-year high, and unemployment remains below 4%.

It is difficult to overstate the uniqueness of this economic cycle. There was unprecedented monetary and fiscal stimulus in 2020 and 2021, followed by a rapid rise in interest rates in 2022 and 2023 as inflation reached levels not seen since the 1970s. In the housing market, many homeowners locked in low mortgage rates during the past few years, effectively limiting the impact of rising interest rates. The labor market remains relatively tight after five million workers left the labor force during the pandemic and didn’t return, which has not been seen before. These themes will not reverse quickly and will have long-lasting impacts, which the Federal Reserve and markets must navigate.

We will continue monitoring financial markets and the economy, providing timely updates, and adjusting portfolios as needed.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.