Stocks Are Still Searching for Direction

Photo Credit: Brendan Church, Unsplash

Weekly Market Recap for May 10, 2024

This week, stock valuations began to recover after a negative April performance. Corporate earnings reported for the first quarter of 2024 have been healthy. The earnings season is winding down, and results have generally been better than many investors on Wall Street had anticipated. Notably, many management teams appear more optimistic about business trends for the remainder of 2024 and into 2025.

Significant economic data will be announced next week. Investors and the Federal Reserve will closely monitor the releases of the Producer Price Index and the Consumer Price Index figures for indications of whether or not inflation slowed in April.

S&P 500 Index (Last 12 Months)

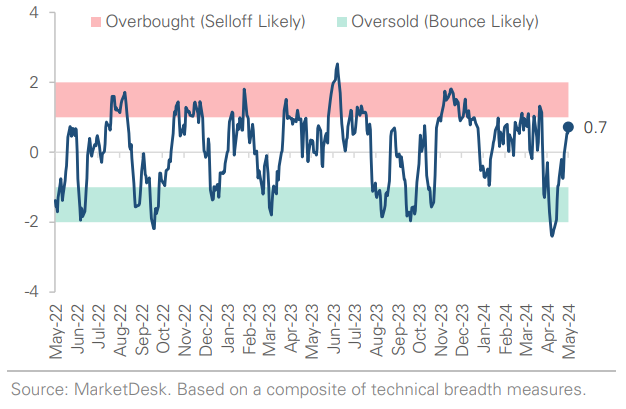

S&P 500 Technical Composite (Last 24 Months)

Market Technicals

The market's intermediate (3-6 months) path forward is fuzzy after the April selloff and bounce. Our Composite Indicator (USBI) dropped from 74 in early April to 52 last week. The current 52 USBI reading signals that the S&P 500 is at a crossroads. Periods like today, when USBI drops below 60, set off a debate in the market about whether the selloff will continue or stocks will bounce. The debate creates a push-pull effect, leading to a broader range of potential return profiles and increased market volatility. Forward win rates are in line when USBI is between 50 and 55. However, forward returns are below average over the next 1-, 2-, 3-, and 6-month periods. The takeaway is that the S&P 500 can still trade higher, but returns will likely be muted.

Stocks Trade Back to 2024 Highs After April Sell-Off

GDP & Earnings Growth

The 2024 real GDP growth estimate bottomed at +0.6% in August 2023. It's been revised higher over the past three quarters and is now +2.2%. Despite mixed macro signals, the May Monthly Roundup discussed the market's +12% EPS growth forecast for the next 12 months. Stocks and short-term rates price in GDP growth and earnings expectations, making identifying a catalyst to increase stocks and short-term rates challenging. However, long-term rates do not reflect those expectations, leaving the long end of the yield curve vulnerable to a shift higher..

S&P 500 Year-Over-Year Earnings Growth Projection

S&P 500 vs Fabolous Five Earnings Projection

Soft Labor Market Data Sparks Bond Rally

April's nonfarm payrolls report was good news for a market craving rate cuts. The Fed's current policy stance is asymmetric, and the market knows it. The bar to cut rates is lower than to hike, so the 2-year Treasury yield dropped nearly -0.10% after the weak jobs report. The Friday decline added to the 2Y's -0.10% decline on Wednesday/Thursday after the Fed tapered QT by $35bn instead of $30bn. The FOMC meeting and April payrolls set off a narrative shift, with the market betting that softer labor data will lead to earlier rate cuts. Falling energy prices have increased the market's conviction, with oil prices down almost 10% since early April. The market's reaction function was to buy stocks and bonds.

Examining the Latest Narrative

The Fed wants to cut, but it will likely act slower than the market thinks. The central bank believed it had solved inflation at the end of 2023 but lost confidence this year. If the Fed previously wanted two consecutive months of favorable data, it may now want three or four months. While the labor market is softening, the overall economy continues to expand steadily. Next week will be busy with a long list of April data points, including CPI, retail sales, housing starts, industrial production, and import prices. The data will test the market's latest narrative (softer growth + lower inflation = rate cuts).

Economic Recap

ISM Mfg PMI

Actual: 49.2

Consensus: 50.0

Prior:50.3

Commentary: Dropped back into contraction after signaling expansion in March. The most significant movement was Prices Paid Index, which rose to a 2-year high. New Orders slipped into contraction, hinting at soft demand.

ISM Services PMI

Actual: 49.4

Consensus: 52.0

Prior: 51.4

Commentary: Lowest reading since December 2022. Dropped below the key threshold of 50 into contraction; decline attributed to lower business activity, slower new orders growth, and employment contracting faster.

Nonfarm Payrolls

Actual: +175k

Consensus: +235k

Prior: +315k

Commentary: This is the slowest job growth since October 2023. February and March were revised lower by a combined -22k. Health care, transportation, and retail trade drove gains as hiring slowed across most industries. Unemployment ticked higher to 3.9% but remained below the key threshold of 4%.

Senior Loan Officer Survey

Actual: 15.6%

Prior: 14.5%

Commentary: Large banks kept lending standards unchanged in Q1, while about 1/3 of smaller banks tightened standards. Banks reported modestly weaker demand and fewer inquiries for C&I loans and credit lines. Some banks started to tighten consumer lending standards for credit cards and auto loans. Overall, the lending environment continues to improve compared to two to three quarters ago.

Consumer Credit

Actual: $6.3bn

Consensus: $15.0bn

Prior: $15.0bn

Commentary: The forecast as revolving credit (e.g., credit card) growth stalled. The survey suggests that tighter lending standards had an impact, which is concerning given that consumers account for 70% of GDP.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.