Tracking the Impact of the Fed's Rate Cuts on the Economy

Weekly Market Recap for October 18th

This week, the S&P 500 reached a new all-time high, bringing its year-to-date count to nearly 50. The index's gains were led by a unique combination of sectors, with Utilities, Financials, and Real Estate each gaining over +3%. The Magnificent 7 underperformed the index, with factor returns hinting at a market rotation. The Russell 2000 gained over +4% as regional bank and biotech stocks rallied, and the Value, Momentum, Equal Weight, and Low Volatility factors all outperformed the broad index. Treasury yields declined early in the week but ended flat following solid economic data on Thursday. The US dollar strengthened further, and oil prices declined by over -6.5% as last week's geopolitical premium faded, and OPEC revised its demand forecast to lower.

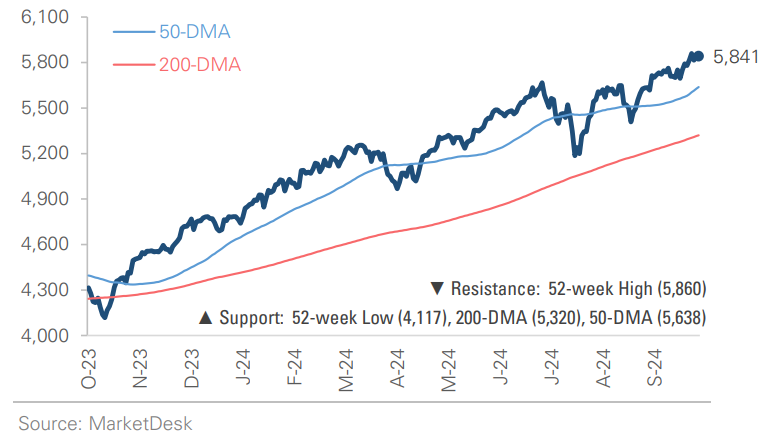

S&P 500 Index (Last 12 Months)

S&P 500 Technical Composite (Last 24 Months)

Tracking the Impact of Rate Cuts

The Rate-Cutting Cycle Index (RCCI) tracks 12 data points across housing, consumer spending, loan growth, the labor market, and business investment to assess the impact of the Fed’s rate cuts on the economy. Early data releases for September are encouraging. Retail sales data indicates that consumers continue to spend, and initial jobless claims decreased after a spike caused by hurricanes and strikes. Despite the positive data, some concerns remain. We are closely monitoring business investment, which affects manufacturing and housing activity. The ongoing Boeing strike and hurricanes distorted industrial production in September, but the underlying trend remains sluggish. Homebuilder sentiment rose by 1 point to 43 in October but still remains weak. We would like to see manufacturing and housing improvements, continued consumer spending, and stable unemployment.

Rate Cutting Cycle Index

Retail Sales Remain Strong

Industrial Production Remains Sluggish

High-Yield Bond Credit Spread Remains Tight

The high-yield credit spread has been the tightest since May 2007. This tightness reflects the current environment: the economy continues to grow despite higher rates, the stock market is near all-time highs, and the Fed is lowering rates. We monitor the high-yield spread for signs of risk appetite, as it’s an important input to USRDI in the Quant Pack. Today’s tight spreads signal economic stability, strong market liquidity, investor willingness to buy risky assets, and low perceived default risk. However, with tight spreads, now is the time to be mindful of exposure to credit spreads. The risk is highly asymmetric: while spreads are unlikely to tighten much more, they could widen if investors sense economic weakness.

High-Yield Bond Credit Spreads Tightest Since 2007

Regional Banks Report Strong Credit Quality

Four regional banks reported earnings with one common theme. While deposit and loan growth were mixed, credit quality remained strong. M&T Bank reported decreased net charge-offs and non-accrual loans compared to the prior quarter. Commerce Bank said, "Credit quality remains excellent." Huntington Bancshares said, "Credit trends overall are holding up very well." S&T Bank reported "continued improvement in asset quality" and another quarter of declining credit loss provisions. The strength of loan portfolios is another encouraging development.

Looking Ahead

Q3 earnings season continues next week, as the economic calendar slows before picking up again the following week. The Treasury will release its borrowing estimate the week of October 28th, which could impact equity and credit markets depending on the size of the financing estimate and the composition of bills and bonds it plans to issue. The calendar becomes much busier the first full week of November, with the election and November FOMC meeting both less than three weeks away. The two events are hanging over financial markets, and their passing should remove some uncertainty.

This week's economic data releases included:

Retail Sales

Actual: +0.4%

Consensus: +0.35%

Prior: 0.06%

Commentary: It was another strong month of consumer spending. Categories with gains included food services and drinking places, online retailers, general merchandise, and food and beverage stores; gasoline stations (falling prices); and electronics and furniture declined. Control group retail sales signal underlying consumer strength.

Industrial Production

Actual: -0.3%

Consensus: -0.1%

Prior: +0.3%

Commentary: Industrial activity remains sluggish, and the manufacturing subindex remains weak. (Note: The Fed estimates that the Boeing strike and Hurricanes Helene and Milton combined to hold down activity by -0.6%.)

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.