2021 Q2 Recap and 2021 Q3 Outlook

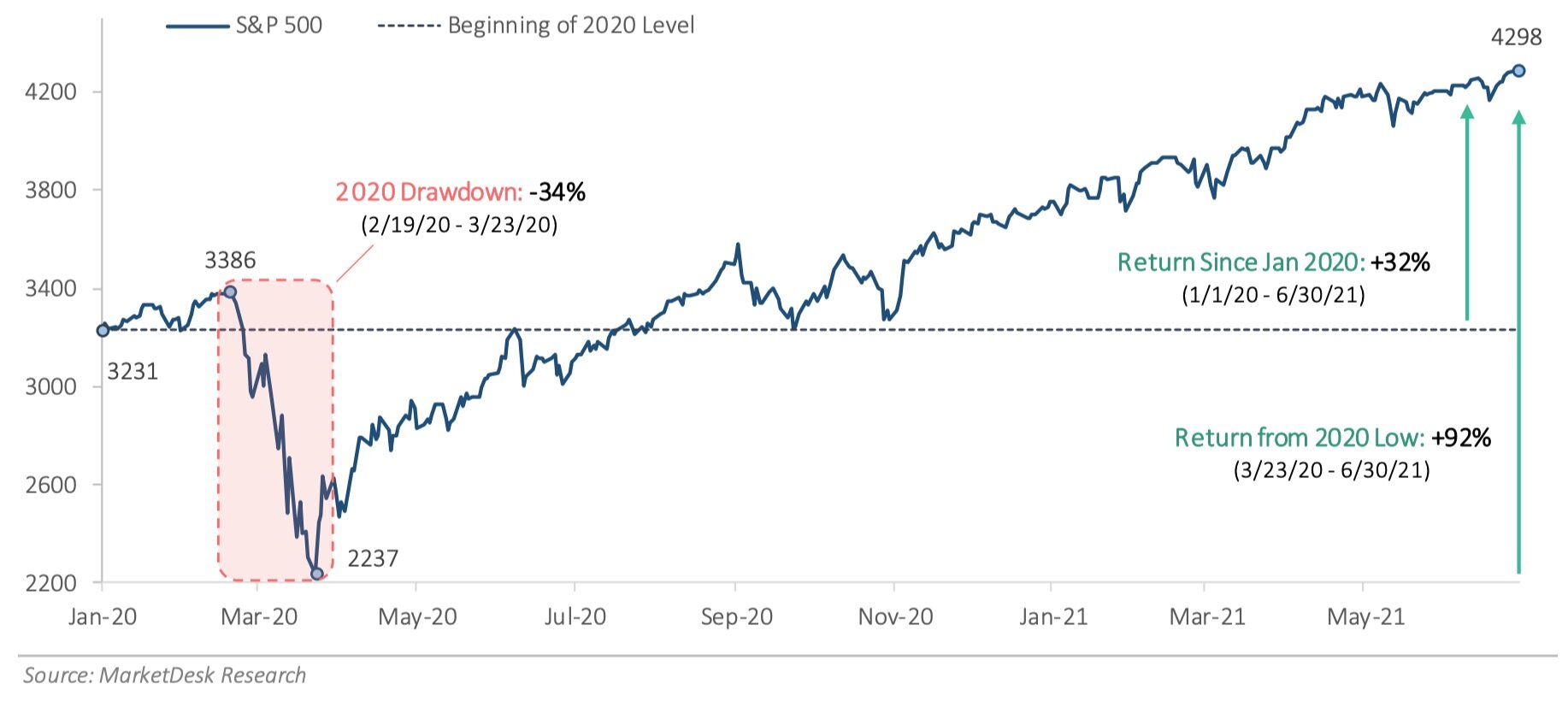

S&P 500 Performance Since Pre-Pandemic

Returns on the S&P 500 have held strong after the significant pullback experienced in the early part of 2020.

Economic Rebound Continues as Economy Reopens

The reopening pace accelerated during the second quarter. Rising vaccination rates allowed more states to ease restrictions. Indoor dining capacity restrictions were lifted, and stadiums filled up as fans returned to the stands. Subway ridership rose, and the skies grew more crowded as people booked vacations. Economic data confirmed the economy’s recovery as the labor force grew and unemployment claims fell. The outlook improved as life gradually returned to normal. This quarterly letter looks at inflation headlines, interest rates, and market performance as we enter the second half of 2021.

Inflationary Pressures Accompany Economic Reopening

Rising inflationary pressures also grabbed the market’s attention during the second quarter. Manufacturing costs rose due to supply chain bottlenecks, high raw material costs, and global shipping challenges. Labor costs also rose as companies struggled to fill open jobs. Figure 1 shows the record number of job openings, which is causing companies to increase wages as they compete for workers. The labor supply crunch is expected to ease later this year as enhanced unemployment benefits end, virus fears recede, and schooling returns to in-person.

These inflationary pressures are starting to show up in consumer prices. The headline consumer price index rose 4.9% year-over-year in May 2021, which was the fastest pace since September 2008. The key question is whether current inflation pressures are transitory (i.e., temporary) or longer lasting. The Fed views inflationary pressures as transitory and points to big price drops early in the pandemic artificially making today’s inflation figures look higher. As further evidence, data indicates most of the price pressures are occurring in categories where demand is soaring as the economy reopens, such as used cars, air travel, and hotel rooms.

The Fed previously said it would let inflation run slightly above its target to make up for years of weak inflation. The Fed’s new inflation policy suggests it will wait longer to raise interest rates, which is why the market was caught off guard by the Fed’s change in tone at the June meeting. The risk is inflation runs too high and forces the Fed to raise interest rates sooner rather than later.

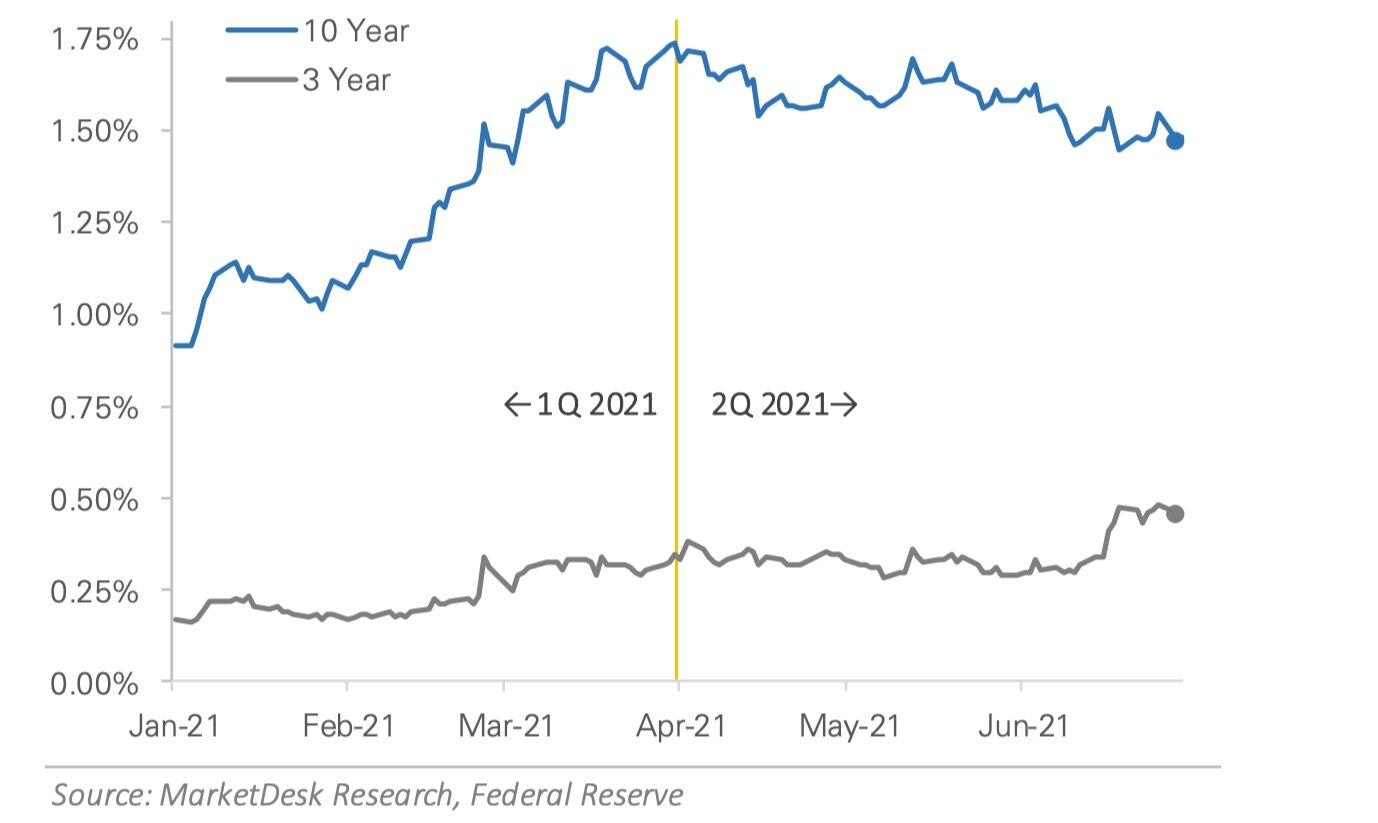

Credit Market Repositions Due to Fed & Inflation

The credit market also felt the effects of the Fed’s changing outlook and rising inflationary pressures. After long-term interest rates rose during the first quarter in anticipation of a stronger economy, investors reversed course and rates moved lower during the second quarter. The move lower was especially pronounced in long-term rates. Figure 3 shows the 10-year Treasury yield fell from 1.74% at the end of March to 1.45% at the end of June. Falling interest rates support higher bond prices, which caused longer maturity bonds to outperform during the second quarter.

US Treasury Interest Rate Changes in 2021

While long-term rates fell during the second quarter, Figure 3 shows short-term rates rose. The 3-year Treasury yield rose from 0.34% at the end of March to 0.45% at the end of June. The timing of the move higher in short-term rates coincided with the Fed’s June meeting, suggesting investors are already positioning for the Fed to start hiking short-term rates. The move higher in short-term rates, paired with the move lower in long-term rates, suggests investors are more concerned about the risk of the economic recovery slowing.

Second Half 2021 Outlook – A Confused Market

Market volatility is picking up as the second quarter comes to an end. Investors are struggling to interpret the Fed’s recent change in tone and the potential impact from inflationary pressures. The big question is whether investors will return to the reflation trade later this year, and asset class returns are producing mixed signals. Interest rates rise one week and fall the next as the market attempts to find a new normal. Cyclical sectors outperform one week only to underperform the next week. There is a push and pull occurring beneath the market surface as the market struggles for direction.

The unresolved questions will likely continue to weigh on the stock market in the coming months. However, this does not mean the market will necessarily trade lower. It simply means the ride could be bumpier in the months ahead. The pandemic’s unique nature and corresponding quick economic reopening are unlike recent recessions. Figure 4 shows the S&P 500 Index has returned 92% from its pandemic low point and 32% since the start of 2020. The market has already priced in a strong recovery, and the second quarter performance reversal suggests the market may have gotten ahead of itself. The next quarter will provide new information about the ongoing recovery. As Fed Chairman Jay Powell has repeatedly stated, there is not a template or model for the current recovery.