Making Sense of the Tariff Announcement

Photo Credit: Getty Images, Unsplash

Trump Administration Introduces New Tariff Measures

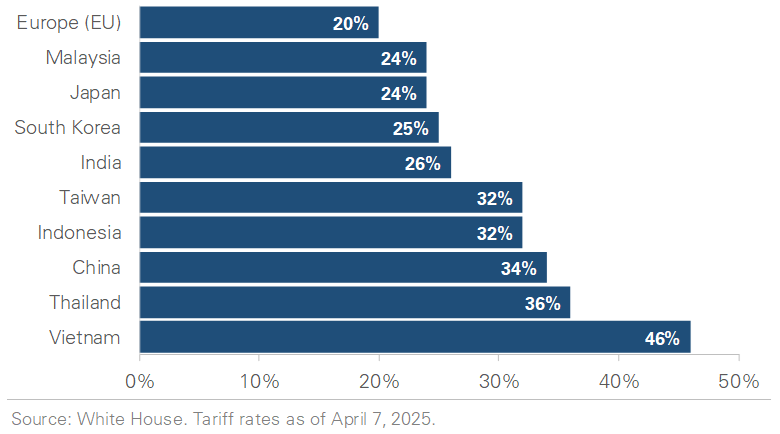

On April 2nd, the Trump administration unveiled a sweeping set of tariffs. Unless specific exemptions are granted, a baseline 10% tariff applies to all imports from all countries. Additional “reciprocal tariffs” target approximately 60 countries deemed the worst offenders based on existing tariffs on U.S. goods, perceived trade barriers like currency manipulation, and subsidies to domestic industries. The chart below, graphs the combined baseline plus reciprocal tariff rates across key countries. The rates range from 46% in Vietnam to 20% in the EU and span multiple regions, from Southeast Asia to China and Europe.

A History Lesson on U.S. Tariffs Over the Past Century

Tariffs are back in the spotlight but have been part of US policy for over a century. The chart below graphs the average tariff rate on US imports since 1891, calculated as the total amount of duties collected divided by the total value of imports. In 1899, the average tariff rate was 29%, a time when the US relied heavily on tariffs for federal revenue and to protect domestic industries. Over time, tariff rates declined due to the rise of globalization and a shift from protectionism to more open and free trade. The average rate was between 1% and 3% in recent years. However, the newly announced tariffs represent a turning point. The Yale Budget Lab estimates the average tariff rate will rise from less than 3% in 2024 to over 20%, the steepest level in nearly a century.

The Uncertain Impact of Tariffs on a Complex Global Economy

The new tariffs carry significant implications for financial markets and the economy, but their impact is difficult to predict given the complexity of global trade and the range of potential responses by countries. The timeline is also uncertain, and tariffs could remain in effect for weeks or years, depending on negotiations. Countries could retaliate with tariffs, leading to a global trade war. Economic effects like higher inflation and slower growth are possible but also uncertain. The new tariffs are only a few days old, and their impact will unfold gradually over months as supply chains adjust. Economists expect businesses to absorb some tariff costs in the near term, softening the impact. However, there is little consensus about how much they will absorb or how they will respond, such as pausing investment or holding back on hiring.

Focus On What You Can Control: Staying Disciplined with Your Long-Term Goals

The impact of today’s tariffs is uncertain, but history shows that the economy and market usually adapt to changing environments. Rather than reacting to headlines and market volatility, staying focused on your financial plan, maintaining a well-diversified portfolio, and making decisions aligned with your long-term goals is best.

Tariff Rate Across Major Trading Partners

Average Tariff Rate on US Imports

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.