Market Volatility, 90-Day Reciprocal Tariff Pause, and Investor Dip Buying

Photo Credit: Peter Aschoff, Unsplash

Weekly Market Recap for April 11th

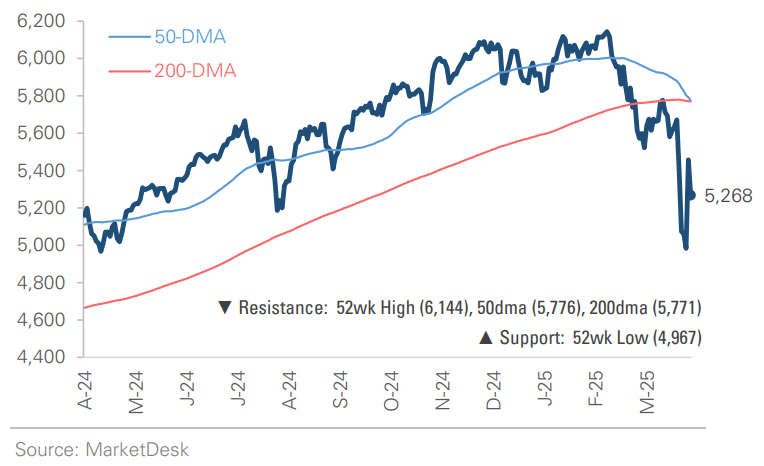

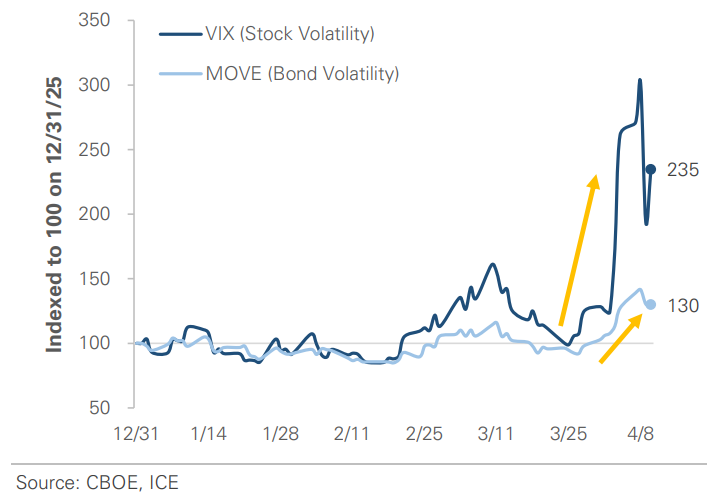

Markets remain volatile, with the CBOE VIX and MOVE Index still elevated. The S&P 500 fell -2.4 %, but the decline masked sharp swings, with intraday moves of over 7% on three of four trading days. Despite the loss, the tone was broadly risk-on after President Trump announced a 90-day pause on reciprocal tariffs. Previously lagging areas rallied, led by the Nasdaq, Technology, and high-beta stocks, while defensive sectors and low-volatility factors underperformed. Treasury yields reversed sharply higher, with the 10-year rising to its highest level since February 20th. High-yield bonds outperformed during the relief rally, although credit spreads remain near a 17-month high as uncertainty and stress spread to the bond market. The US dollar has weakened to a 3-year low amid the uncertainty, while oil trades near a 4-year low. Markets have experienced several significant multi-standard deviation events in recent weeks. Until more clarity, we expect volatility to remain elevated and asset gains to be limited.

S&P 500 Index (Last 12 Months)

S&P 500 Technical Composite (Last 24 Months)

Bull Bear Market Indicator

US Market Economic Cycle

S&P 500 Valuation Matrix

Key Takeaways

#1 - The Consensus Was That The Global Economy Could Not Handle The Level of Proposed Tariffs

The market pressured the Trump administration to change course, and it was rewarded on Wednesday when Trump paused reciprocal tariffs for 90 days.

Implication: The equity market gapped higher after the announcement, removing a major tail risk and narrowing the outcome range. The hardest hit factors and companies rallied the most.

Market Volatility is Evaluated

S&P 500 Is Experiencing Large Intraday Swings

10-Year Treasury Yields Surge to February Yields

#2 - The Market Was Primed To Bounce On Any Good News

Our US Market Capitulation indicator shows that historically, readings at or below -3 have signaled attractive buying opportunities. However, the market gave back nearly half of those gains on Thursday. As we have highlighted in recent posts of the Market Update, the current reading reflects the lack of volatility in recent years rather than investor capitulation.

Implication: When volatility rises from such a low base, moves can appear bigger, contributing to feelings of the selloff being overdone.

US Market Capitulation Indicator

#3 - A Powerful Market Psychology Has Taken Hold Of Buying The Dip

Swift recoveries have often followed periods of market volatility as the Fed responds with rate cuts or quantitative easing. Dips have become less about fear and more about opportunity, a trend that has reshaped investors' responses.

Implication: Many investors were eager to buy the dip this week after years of being conditioned to expect rebounds.

#4 - Policy Uncertainty And An Eagerness To Buy The Dip Are Fueling Volatility

A risky setup that can produce sharp, unpredictable swings, like on Monday when markets surged and then quickly reversed on unconfirmed news of a 90-day pause. When the pause was confirmed on Wednesday, the S&P 500 produced one of its best days in history, only to give back a portion of the gains on Thursday.

Implication: Volatility is high as investors chase headlines, and it is unlikely to calm down until there is clarity.

#5 - Even With The 90-Day Pause, Uncertainty Remains

A blanket 10% tariff is still significant, which is getting overlooked given the extreme levels of proposed rates. The economy could avoid a recession under 10% baseline tariffs, but it would still be a big shock to the global economy and financial system.

Implication: Rising policy uncertainty has already weakened sentiment, causing consumers and businesses to delay purchases and other decisions. The 90-day pause provides immediate relief to the market but still leaves businesses in a very uncertain environment.

#6 - Our Outlook

Our U.S. Risk Demand Indicator (USRDI) remains risk-off at -1.25 (Note: It has remained negative since Feb-26th), with pain in the equity market spreading to high-yield bonds. While valuations have declined, the S&P 500 trades at over 19x its next 12-month earnings, above pre-pandemic levels. Markets are pricing in policy uncertainty and a mild slowdown, but in the event of a recession, equities have further downside.

Implication: The market experiences bigger drawdowns in risk-off regimes. The takeaway is to consider buying the dip in risk-on regimes but selling the rip in risk-off regimes.

US Risk Demand Indicator

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.