Tariff Announcement - 6 Key Questions

Photo Credit: Denise Jans, Unsplash

What is the tariff structure?

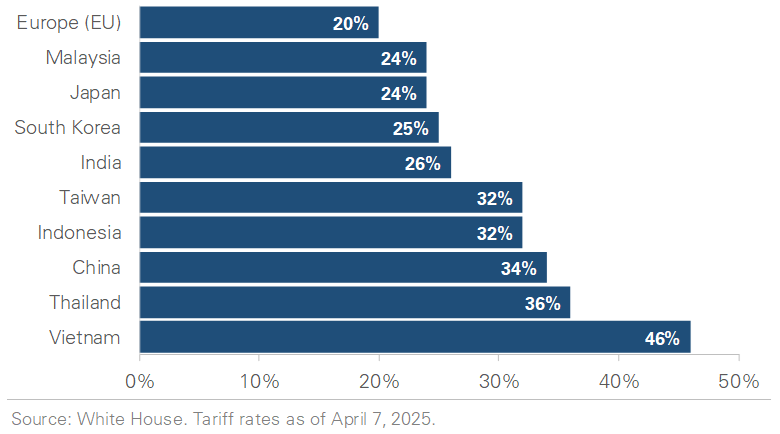

The Trump administration unveiled a sweeping set of tariffs. Starting April 5, 2025, a universal 10% tariff will be imposed on all imported goods, applying to all countries unless specific exemptions are made. Additional “reciprocal tariffs” targeting approximately 60 countries deemed the “worst offenders” in trade practices will begin on April 9, 2025. Rates vary, with some as high as 54% (e.g., China), calculated based on perceived trade barriers like tariffs, currency manipulation, and subsidies.

Tariff Rate Across Major Trading Partners

Average Tariff Rate on US Imports

How long will this situation last?

This is the steepest U.S. tariff regime in a century, aimed at shrinking a $1.2 trillion trade deficit and boosting manufacturing. The plan has been developing since the presidential campaign, with Trump and his team arguing that the tariffs will revitalize American industry and address decades of “unfair” trade practices.

Trump’s calling it ‘Liberation Day,’ signaling he may be in it for the long haul. Still, other countries may retaliate, potentially leading to shifts in policy. The timeline remains uncertain—it could last for years or weeks if negotiations make progress.

Are we heading towards a recession?

Trading partners have voiced strong concern over the newly announced 10% baseline and reciprocal tariffs, with the EU, China, and others threatening retaliation. However, no concrete countermeasures have been imposed yet. A full-blown trade war remains a risk but not a certainty.

Economists say these tariffs could lower GDP growth in the quarters ahead and push inflation higher. That is a concern, but there’s no consensus on a recession yet—growth could slow rather than turn negative. In 2018, Trump’s tariffs (e.g., 25% on steel) slowed growth but did not trigger a recession, thanks to strong consumer demand. Today’s broader scope—covering all imports—raises the stakes, but it is not a straight line to recession.

What is happening with my investments?

Markets reacted sharply to the tariff announcements. Stocks opened lower today, with companies that import goods hit the hardest. Examples include Apple, Ford, Nike, and other heavy importers. Treasury yields are falling as investors move to safe-have assets, and bonds provide diversification benefits to cushion some of the selloff. Oil prices are declining due to concerns about slower growth.

Markets tend to react negatively to uncertainty, and today’s volatility reflects that. However, many of these early moves are knee-jerk reactions based on assumptions and incomplete information. It will take time for the true impact to show up in economic data and company fundamentals. We closely monitor developments, but there is no need to lock in a guess today. Days like today are why we built diversified portfolios that span across stocks, bonds, commodities, and other asset classes.

How will these tariffs affect my cost of living?

The 10% tariff starts April 5, and reciprocal tariffs start April 9. Immediate price hikes are possible but not certain—supply chains need time to adjust. In the long term, there are estimates that these tariffs could add about $1,000 to your yearly expenses—think about the higher costs for phones or cars. But it is early, and prices will not spike overnight. Economists expect firms to absorb some tariff costs in the short term, softening the blow, but there is no consensus about how much.

What should I do now?

Tariffs will begin in a few days, but their impact will unfold gradually over the coming months. From a budgeting perspective, planning for a slight increase in your monthly expenses is wise. That said, there is no need to make major changes right now. If you have been considering a big purchase like a car, it might make sense to do it sooner rather than later due to the potentially higher costs of imported vehicles and parts. However, when it comes to investments, it is best to stay patient and reassess once the tariffs take effect rather than make any immediate changes.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.