Comparing the Cost of Renting vs Buying in Today’s Market

Photo Credit: Spacejoy, Unsplash

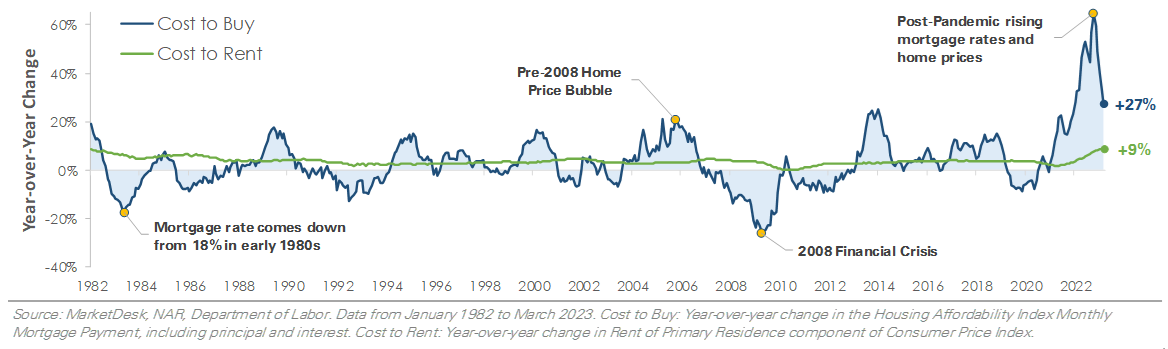

Rent vs. buy – it’s a big question with significant financial implications. Do you make a down payment, take out a mortgage, and build equity? Or do you rent, give yourself more financial flexibility, but miss out on the opportunity to build equity? This month’s chart, which tracks year-over-year growth of monthly rent and mortgage payments since the early 1980s, compares the cost of renting vs. buying a home. Looking at the chart, one trend is immediately apparent – the cost of renting is less volatile than buying.

Why are mortgage payments more volatile? Purchasing a home is naturally more volatile due to fluctuating home prices and mortgage rates, which directly impact both the loan size and interest charged. For example, monthly mortgage payments grew rapidly in 2005 and 2006 with home price inflation. After the housing bubble popped during the 2008 financial crisis, mortgage payments declined -25% in 2009 as home prices and mortgage rates fell, even as rents grew.

Year Over Year Change in Monthly Mortgage and Rent Payments

The past few years have highlighted the volatility of mortgage payments as homebuyers felt the strain of rising home prices and mortgage rates. S&P’s 20-City Composite Index rose monthly from June 2020 through June 2022, with home price growth peaking at +21.2% year-over-year in April 2022. In parallel, the average 30-year fixed-rate mortgage climbed from less than 3% in early 2021 to 7% today. While rent payments are rising faster than in four decades, mortgage payments are rising even faster due to increasing home prices and mortgage rates.

How do you navigate the current housing market? This is a unique housing market because of the volatility in home prices, mortgage payments, and rent payments. Data shows home prices declined each month from July 2022 through February 2023, but the challenge is prices are still elevated, banks are tightening lending standards, and mortgage rates sit near 7%. Plus, homeowners who refinanced in the past few years will give up their low rate when they sell. Since buying a home is one of the most significant purchases most individuals will make, we recommend taking the time to make an informed decision. Our team stands ready to help when considering your investment portfolio and overall financial plan.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.