First-Quarter 2023 Earnings Season Recap and Commentary

Photo Credit: Andrew Dawes, Unsplash

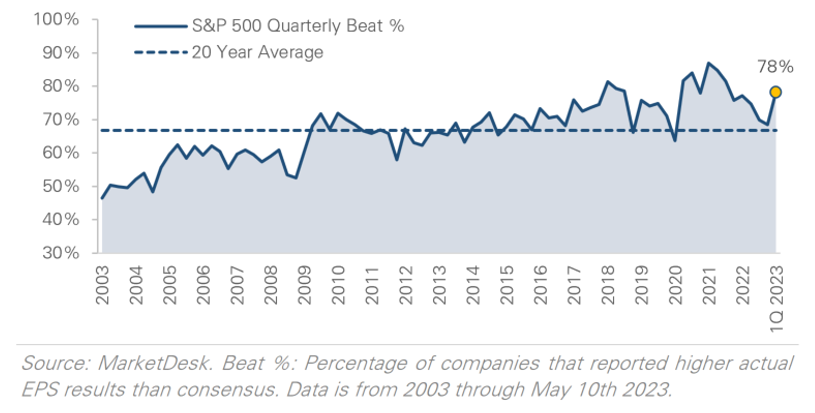

More than 90% of S&P 500 companies have reported Q1 2023 earnings, with results exceeding expectations. The chart below, "Percent of S&P 500 Companies Beating EPS Estimates," shows 78% of S&P 500 companies reported Q1 earnings that surpassed their estimates, up from 68% in Q4 2022 and above the 20-year average of 67%. The above-average number of earnings beats is encouraging, but there is a potential explanation.

Percent of S&P 500 Companies Beating EPS Estimates

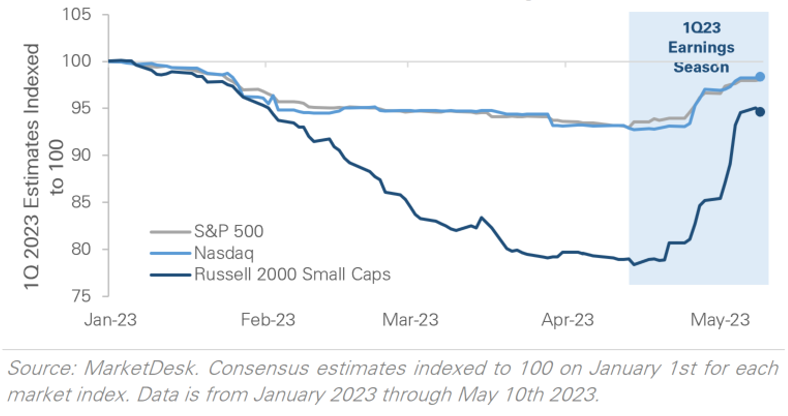

The "Path of YTD Revisions to Q1 2023 Earnings" chart shows that first-quarter earnings estimates for the S&P 500, Nasdaq 100, and Russell 2000 were revised lower throughout Q1. Those downward revisions may have set the bar too low, leading to more companies beating expectations. Estimates were revised higher over the past month as more companies reported first-quarter results. The upward revisions and the 78% beat rate suggest Wall Street analysts were too pessimistic.

Path of YTD Revisions to Q1 2023 Earnings

Companies are also providing additional context on earnings calls. Here’s what some well-known companies are saying about the current economic environment:

UPS (Logistics): “… volume was higher than we expected in January, close to our plan in February, and then moved significantly lower than our plan in March…”

Bank of America (Diversified Bank): “Consumers’ financial positions generally remain healthy. They are employed with generally higher wages, continue to have strong account balances, and have good access to credit.”

Caterpillar (Machinery): “Backlog ended the quarter at $30.4 billion, flat relative to the fourth quarter of 2022.”

Chipotle Mexican Grill (Restaurant): “… we’re seeing new customers come in and we’re also seeing existing customers increase their frequency.”

Numerous companies report that the U.S. consumer is financially healthy, such as strong account balances at Bank of America and more meals at Chipotle. This activity is positive because the consumer historically accounts for 70 percent of U.S. economic activity. However, commentary from other companies suggests activity may be peaking. UPS’s declining package volumes suggest consumer spending fell as the quarter progressed, while Caterpillar’s flat backlog indicates construction, mining, and drilling activity remains elevated but may be peaking. The mixed messages explain why analysts were cautious entering earnings season. We believe earnings will remain in focus this year as the market deciphers how higher interest rates will impact the economy.