Housing Market Cools as Interest Rate Increases Impact Economy

Housing Starts and Building Permits Decline as Mortgage Rates Rise

The Covid-19 pandemic profoundly altered the U.S. housing market. Homeowners and renters reevaluated their housing needs and want as they spent more time at home. At the same time, remote work set off a great migration as employees decided where they wanted to live based on lifestyle rather than employer location. The two themes created a perfect storm of housing demand and overwhelmed homebuilders.

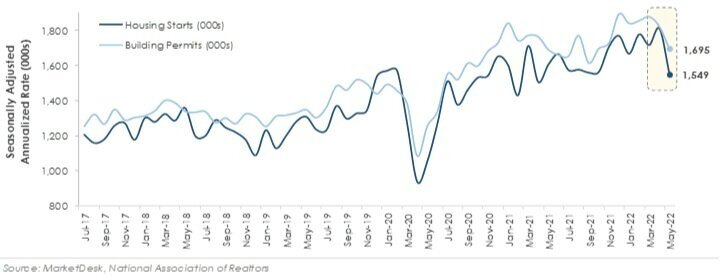

This chart shows the annualized pace of housing starts and building permits steadily climbed after initially plunging during the depths of COVID-19. Housing starts and building permits jumped to their 2006 highs, levels set during the last housing cycle boom in the 2008 financial crisis. Home and building material prices skyrocketed as housing demand outpaced supply.

Recent data points indicate the housing market is cooling. Figure 1 shows the pace of housing starts and building permits declined during the first half of 2022, and data recently released by Redfin appears to confirm the slowdown. The real estate brokerage reported that ~60,000 home purchase agreements fell through during June, equal to 14.9% of homes that went under contract. Based on Redfin’s analysis, it was the highest percentage on record except for March and April 2020.

The ongoing housing market slowdown indicates the Federal Reserve’s interest rate increases are already impacting the economy. Keep in mind that this is part of the Fed’s plan – to ease inflation pressures by reducing demand for goods and services. However, the Fed’s actions are blunt and could start to impact more segments of the economy, such as manufacturing and retail sales. Investors are concerned the Fed is too focused on inflation and will raise interest rates too fast and too high, slamming the brakes on the U.S. economy and starting a recession. If you have read about rising recession fears, this is one of the catalysts behind the concern.