How the Federal Reserve Impacts Your Portfolio and Borrowing Costs

The Federal Reserve increased the federal funds rate +0.25% on March 16th. The market expected the increase, but it will still impact bond yields and lending rates. The federal funds rate is the interest rate banks charge each other to borrow and lend excess reserves overnight, but it also influences the prime interest rate. In turn, the prime rate influences the interest rate on financial products, including credit cards, personal loans, and auto loans. The charts below examine how the Federal Reserve’s action may impact Treasury yields and lending rates.

Path of Rates 24 Months Following the First Fed Rate Hike

Figure 1 charts the average percentage move across U.S. Treasury bond yields, the 30 Yr fixed rate mortgage, and the prime interest rate during the 24 months after the Federal Reserve first raises the interest rate. The chart shows longer maturity Treasury yields, such as the 10Yr and 30Yr, historically rise less than shorter maturity yields, such as the 2Yr. There is a similar dynamic across lending rates ― the 30Yr fixed rate mortgage, which has a longer maturity, historically increases less than the prime interest rate, which is typically a benchmark for shorter maturity loans.

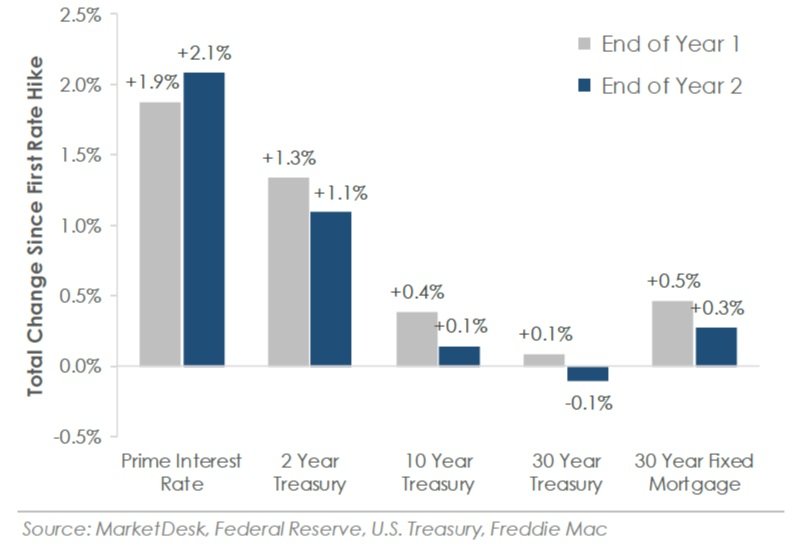

Cumulative Change After First Fed Rate Hike

Why does this occur? The short-end of the Treasury yield curve is more sensitive to Federal Reserve policy, while the long-end of the yield curve is more sensitive to economic conditions. Figure 2 confirms this by showing shorter maturity yields and lending rates, such as the 2Yr Treasury and prime rate, historically increase more on an absolute basis than longer maturity yields and lending rates, such as the 10Yr and 30Yr Treasuries and 30Yr fixed mortgage rate.

How does this impact your personal finances? From a portfolio perspective, higher Treasury yields suggest bonds could produce negative returns. This is because bond prices generally decline as yields rise. Looking at borrowing costs, history indicates interest rates on auto and personal loans could increase significantly over the next 12 months, while mortgage rates could still increase but by a smaller amount. Higher interest rates will increase borrowing costs, which could in turn lead to decreased consumer demand. The Federal Reserve’s goal is to raise interest rates to ease inflation pressure, but it could have the added side effect of slower economic growth.