Labor and Inflation Data Give the Fed the Green Light to Cut Rates

Photo Credit: Aaron Burden, Unsplash

Weekly Market Recap for December 13th

This week, the Bureau of Labor Statistics released the latest inflation data, following recent updates on consumer and producer prices. While November's consumer price index (CPI) and producer price index (PPI) largely met expectations, both showed persistent upward pressure, disappointing Wall Street. We anticipate the Federal Reserve will respond by lowering short-term interest rates at its December 17-18 meeting, likely by 25 basis points to a range of 4.25%-4.50%. Despite inflation remaining stubbornly high, the Fed also considers the labor market. Notably, initial jobless claims for the week ending December 7th exceeded forecasts.

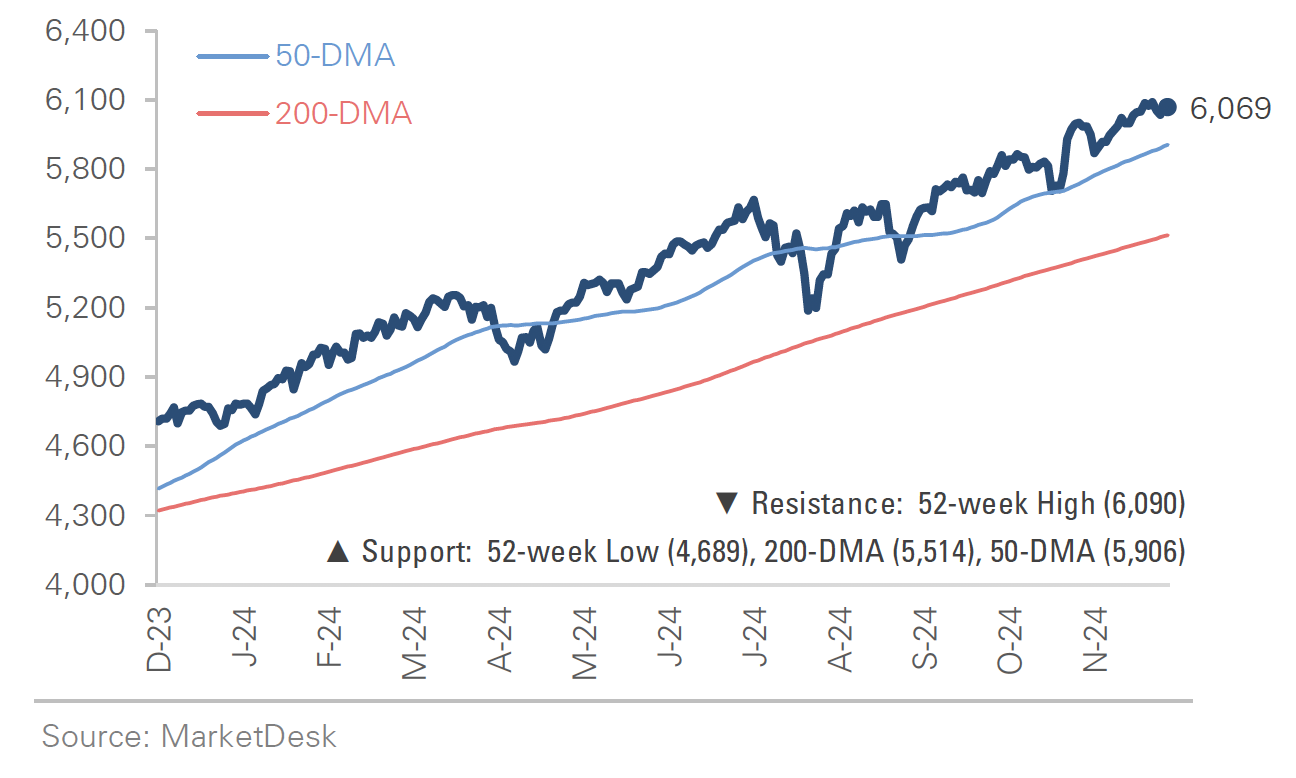

S&P 500 Index (Last 12 Months)

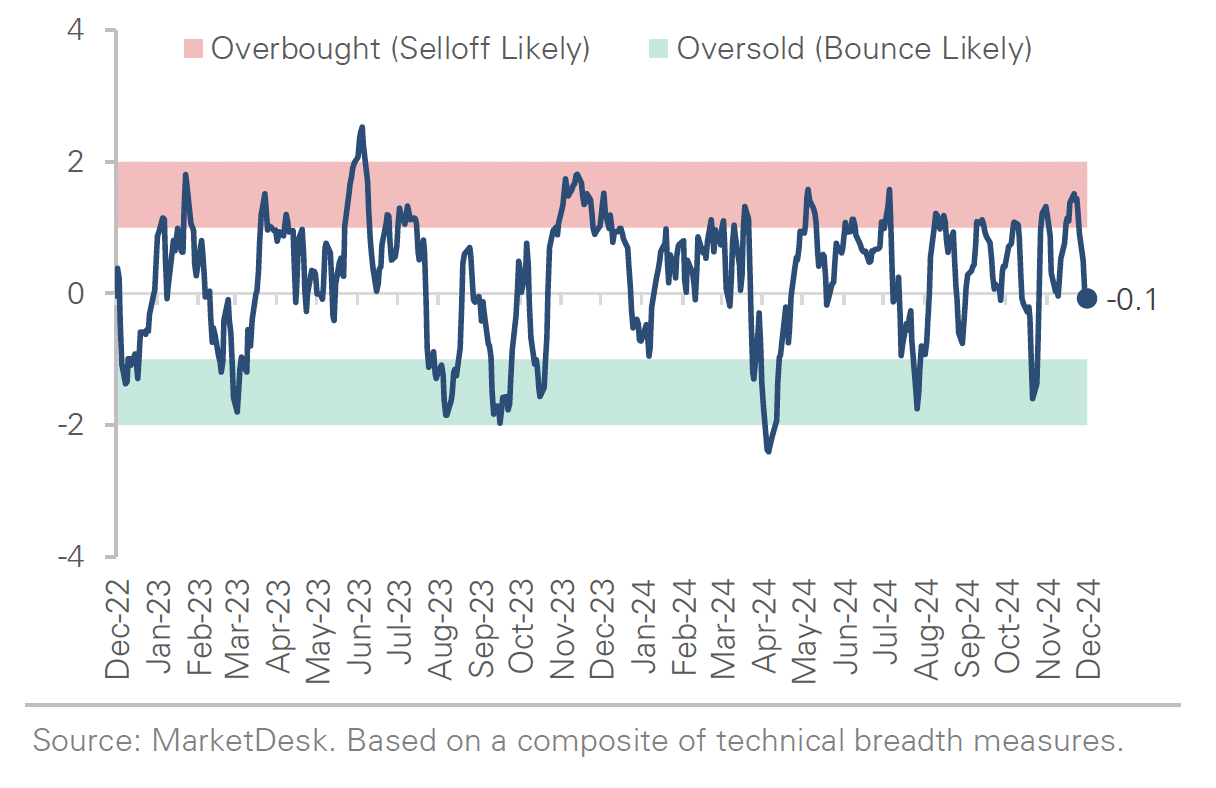

S&P 500 Technical Composite (Last 24 Months)

US Bull and Bear Market Guage

November Job Growth

Last month’s job report offered something for everyone. Unemployment rose from 4.1% to 4.2% after falling in recent months. The most significant contributors were reentrants and new entrants, although permanent job losers and job leavers also contributed. Meanwhile, the number of workers on temporary layoffs declined for a second consecutive month, indicating that companies are recalling employees to offices and manufacturing lines. While unemployment rose, job growth rebounded sharply. Nonfarm payrolls grew by +227,000 following an upwardly revised +36,000 in October. Job gains for the prior two months were revised upwards by a total of +56,000, bringing the 3-month average to +173,000. The question is whether the economy can maintain the recent level of monthly job growth, particularly after the summer slowdown. There was a broad-based slowdown across industries over the summer, and the duration of unemployment increased, suggesting workers had a more challenging time finding new jobs.

US Unemployment Rises to 4.2% in November

US Job Growth

Labor Market Dynamics

Last week’s JOLTS data highlighted the labor market’s continued sluggishness. The number of hires has fallen sharply from post-pandemic highs and is now at levels last seen in early 2017. On the other hand, layoffs and discharges have climbed compared to recent years but remain below the trend from the 2010s. It’s a low-hiring, low-firing labor market. The combination suggests companies were waiting for more clarity around politics and Fed policy. The next few months will provide important context about the summer slowdown. Was it the beginning of a more significant trend or related to uncertainty about the economy and Fed policy? The best-case scenario is that companies start hiring again after the election. One other structural theme continues to weigh on labor supply: the participation rate for workers aged 55 and over remains -1.5% below the pre-pandemic trend. The falling participation rate indicates that workers close to retirement are leaving the workforce and retiring early. The early retirement trend could keep the labor market relatively tight, with a ceiling on unemployment.

JOLTS Hires and Layoffs

Inflation Progress Has Slowed

Headline CPI rose by +0.3% in November, the highest since April. Year-over-year, headline CPI rose by +2.7%, up from last month’s +2.6%. However, the rise matched market expectations, with investors still largely unfazed by the recent uptick in inflation. Core CPI, which climbed +0.3% for the fourth consecutive month, shows inflationary pressures persist. Over the past three months, core CPI has risen at a +3.7% annualized pace, an increase from last month’s +3.6% annualized pace and the fastest since April. This week’s PPI report, which came in above expectations, also highlighted underlying inflation pressures. Headline PPI rose by +0.4% in November, which was above expectations and increased from last month’s +0.3%. Core PPI, excluding food, energy, and trade, rose by +0.1% m/m compared to the previous month’s +0.3% increase. However, core PPI rose by +3.5% y/y for a second consecutive month, underscoring persistent price pressures at the producer level (Figure 6). After dipping earlier this year, headline and core CPI have rebounded sharply since the start of July. The recent rise in inflation should not surprise us, as we previously highlighted inflation’s seasonality. The CPI and PPI data suggest that the bulk of inflation progress is behind us now, and inflation could remain sticky. This is why inflation could stall above the Fed’s 2% target. The lack of concern from both the market and the Fed is notable, given that both relied on falling inflation at the start of summer to justify recent rate cuts.

Headline and Core CPI (3-Month Annual Change)

Core PPI Remains Elevated

Look Ahead

Next week is the Fed's final FOMC meeting of the year. The November jobs and inflation reports give the Fed the green light to cut interest rates by -0.25%, and we expect the central bank to take it. Here is the market's updated Fed funds forecast for the December meeting: 96% probability of a rate cut. Looking ahead to January, the likelihood of another rate cut is about 25%, while the probability of no cut is 75% (i.e., cut in December & pause in January). Expectations for a January pause are driven by recent data showing that inflation stays within the Fed's 2% target as quickly as previously thought. This has led to expectations of fewer Fed rate cuts in 2025. Our focus will be on the Fed's updated Summary of Economic Projections, which will be released next week. We expect the Fed to raise its neutral rate estimate, signaling to the market that it is unlikely to cut as much or as quickly as expected. Long Duration is currently a bet on slower economic growth. Absent a significant deterioration or another growth scare, the long end of the yield curve is unlikely to decline materially.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.