GDP Growth Rebounds During 2Q 2024

Photo Credit: Nick Jio, Unsplash

Weekly Market Recap for July 26th

This week, the Bureau of Economic Analysis (BEA) reported a 0.1% month-to-month increase in the personal consumption expenditures (PCE) price index, matching economists’ outlook for a 0.1% expansion; the headline PCE index was unchanged in May. On a yearly basis, the index rose 2.5%, on par with estimates and below the prior reading of 2.6%.

S&P 500 Index (Last 12 Months)

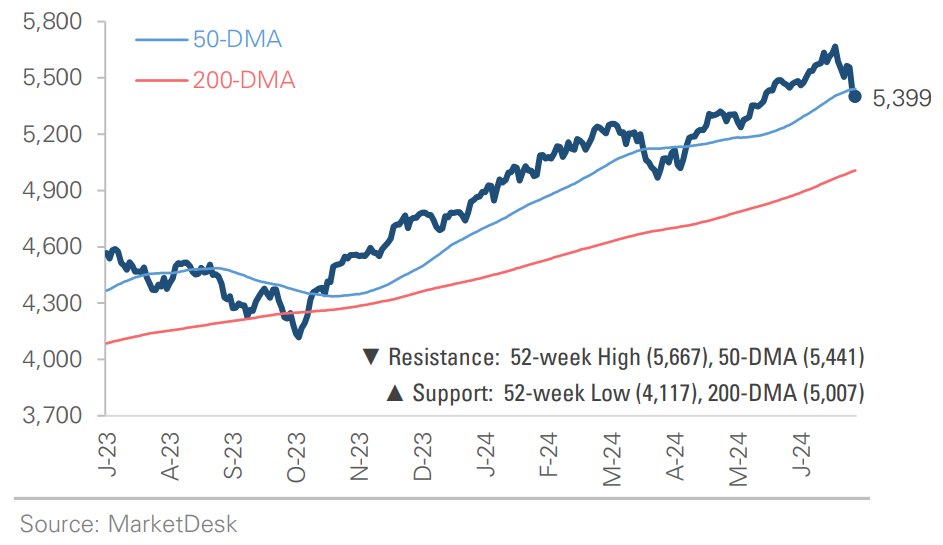

S&P 500 Technical Composite (Last 24 Months)

Bullish and Bearish Narratives

Q2 2024 GDP Growth

In Q2 2024, U.S. GDP grew at +2.8%, an increase from Q1's +1.4%. The Q2 growth primarily reflected increases in consumer spending, private inventory investment, nonresidential fixed investment, and government spending. Compared to Q1, the acceleration in Q2 GDP mainly reflected increases in private inventory investment and consumer spending, partially offset by lower residential fixed investment. The underlying themes were:

Increased consumer spending on goods and services.

Residential weakness in both multi-family and single-family.

Nonresidential investment is driven by equipment and IP as structures decrease (i.e., structures already built and now being filled with equipment).

Government investment and spending at both the federal and state/local levels.

The Q2 GDP print increased from Q1 but was still below last year's strong pace. The economy is cooling due to higher rates, but it's a normalization rather than a recession.

Contribution to 2Q24 Real GDP Growth (%q/q)

July FOMC Meeting

The Federal Reserve holds its next FOMC meeting next week. According to the CME's FedWatch Tool, investors place a 6% probability of a rate cut at next week's meeting. However, investors place a near 100% probability of a cut in September. Consensus shifted decisively toward a September cut following recent cool inflation reports and a rise in unemployment to 4.1%. We expect Chair Powell to lay the groundwork for a September rate cut at next week's meeting while emphasizing the importance of upcoming inflation and labor market reports. Investors expect two more rate cuts before year-end, which implies another -0.50% worth of rate cuts spread across the November and December meetings. There is a broad expectation that the Fed will continue to cut interest rates in 2025, but there needs to be more consensus about the degree of rate cuts. Given the economy's current state, we lean toward fewer rate cuts and expect a mid-cycle cutting regime unless the economy deteriorates materially. As discussed in multiple reports, the long end of the Treasury yield curve is fairly priced.

Interest Rate Cut Expectations for July and September

AI Skepticism Leads to Selloff

Google’s earnings report this week reignited concerns about the costs of building new cloud computing and AI infrastructure. The company’s quarterly capex rose to $13.2 billion, a +90% increase year-over-year. Big tech companies are upgrading and building new data centers, developing and buying specialized computer chips to train and run AI models, and laying transoceanic cables. Wall Street analysts questioned Google about the AI revenue opportunity and whether the industry is moving from underbuilt to overbuilt. There was also concern about how today’s investment would impact future profit margins. Expenses will increase in the years ahead as Google depreciates today’s investments, but there is a question about how much revenue will increase. If revenue grows less than expenses, margins will decline. These concerns led to a sharp sell-off on Wednesday, with the Magnificent 7 declining by more than -5% and dragging down the S&P 500 Index. We expect this issue to gain more attention in the coming months as investors worry about increased costs and decreased profitability.

Google Capex Climbs as AI Buildout Continues

Look Ahead to Next Week

The monthly economic calendar restarts next week with JOLTS, ISM Mfg PMI, nonfarm payrolls, and unemployment. The Fed holds its July meeting, and the U.S. Treasury releases its quarterly borrowing estimate and expected composition of Treasury issuance. It should be another busy macro week.

This week's economic releases included:

Retail Sales Core Durable Goods Orders

Actual: +0.95%

Consensus: +0.1%

Prior: -0.87%

Commentary: Headline orders fell by -6.6%, the first decline in four months & biggest since pandemic; however, excluding volatile defense & transportation categories, core orders rose by +0.95%.

Existing Homes Sales

Actual: 3,890k

Consensus: 3,990k

Prior: 4,110k

Commentary: Lowest since Dec. 2023 and near 2010 levels; 4th straight decline; median price rose to record high.

New Homes Sales

Actual: 617k

Consensus: 635k

Prior: 621k

Commentary: The index declined -0.6% month over month and -7.4% year over year to a 7-month low; high mortgage rates and elevated home prices continue to weigh on demand as the housing market struggles to gain traction.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.