Political Influence with S&P 500 Performance During Election Years

Photo Credit: Cristina Glebova

The stock market is off to a volatile start in 2022, and history suggests it could remain volatile ahead of this year’s midterms. Midterm elections won’t officially occur until November, but the next nine months of campaigning and political speeches will give investors plenty to think about. January’s Chart of the Month aims to separate the emotion of politics from investing by looking at the S&P 500’s historical performance during election years.

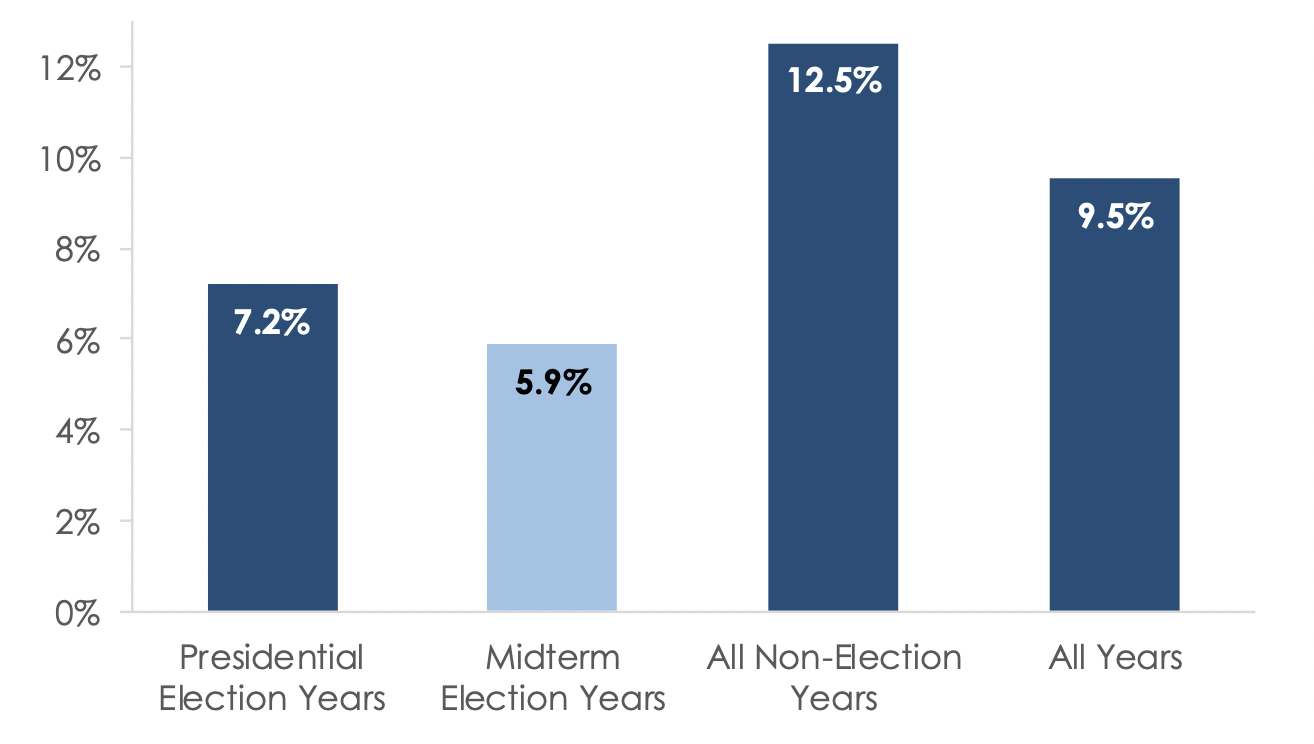

Figure 1 - S&P 500 Price Return Based on Election Cycle

Source: MarketDesk Research. Past performance does not ensure future results

History shows the S&P 500’s returns are typically lower during election years. Figure 1 graphs the S&P 500’s average price return during presidential and midterm elections against non-election years. Since 1950, the S&P 500’s average price return during presidential and midterm election years is +7.2% and +5.9%, respectively. For comparison, the S&P 500’s average price return during non-election years is +12.5%, while the average price return for all years since 1950 is +9.5%.

Figure 2 - S&P 500 Price Return Across 4-Year Presidential Cycle

Source: MarketDesk Research

Figure 2 looks at historical S&P 500 returns from another political viewpoint, the 4-year presidential election cycle. From a timing perspective, 2022 represents year 2 of Joe Biden's presidency. Since 1950, the S&P 500's average price return during year 2 of the presidential election cycle was +5.9%, which is the lowest average return across the election cycle. Taking the analysis a step further, history shows year two returns are generally weak regardless of which political party occupies the White House.

What is the takeaway? The S&P 500’s return is historically lower during midterm election years. It should be noted the analysis does not mean 2022 is destined to follow historical precedent because it may not. Instead, it highlights how elections introduce uncertainty, which investors don’t like. If recent history is a guide, 2022 will likely be another politically charged election year. Above all, it is important to separate your political beliefs from your investment decisions.