Stocks and Potential 2025 Headwinds

Photo Credit: Laura Adai, Unsplash

Weekly Market Recap for November 29th

This week, the Dow Jones Industrial Average has risen 1%, bringing its November gains to over 7%—its strongest monthly performance since November 2023. Meanwhile, the broader S&P 500 Index and the tech-focused Nasdaq Composite have gained 0.5% and 0.4%, respectively. Recent sentiment suggests the central bank might pause rate hikes again as the economy maintains strong growth, potentially reigniting inflation. However, we anticipate the Federal Reserve will lower the benchmark short-term interest rate by 0.25% at the December FOMC meeting, concluding on December 18, likely postponing a federal funds rate pause until 2025.

S&P 500 Index (Last 12 Months)

S&P 500 Technical Composite (Last 24 Months)

US Bull and Bear Market Guage

Crowded Positioning = Fewer New Buyers

The below graph shows households' corporate equity holdings as a percentage of total financial assets. At the end of Q2, corporate equities accounted for 42% of households' financial assets, the highest level since tracking started in the 1940s. Q2's reading surpasses the dot-com bubble and post-COVID recovery in 2021, and given the equity market rally since July, households' stock allocation has likely increased. The second chart shows asset managers' S&P 500 futures positioning, including institutional investors such as pension funds, endowments, insurance companies, and mutual funds. This group's positioning ranks in the 99th percentile compared to the past three years. Asset manager positioning is most effective as a contrarian indicator at extremes, with high readings signaling below-average returns and win rates. The key takeaway: households and asset managers are heavily allocated to equities

US Household Allocation to Stocks at All-Time High

Asset Manager Positioning at Extremes

Investor Sentiment at Extremes

Our US Investor Sentiment Indicator (USSI) recently rose above 90%. USSI is most effective as a contrarian indicator. The likelihood of a large selloff increases when the USSI is above 80%. This effect is more pronounced over 6- and 12-month periods, where stronger sentiment correlates with weaker forward returns. This suggests that while sentiment can drive the market higher, it also increases the risk of significant selloffs.

US Investor Sentiment Indicator

Weakening Market Breadth

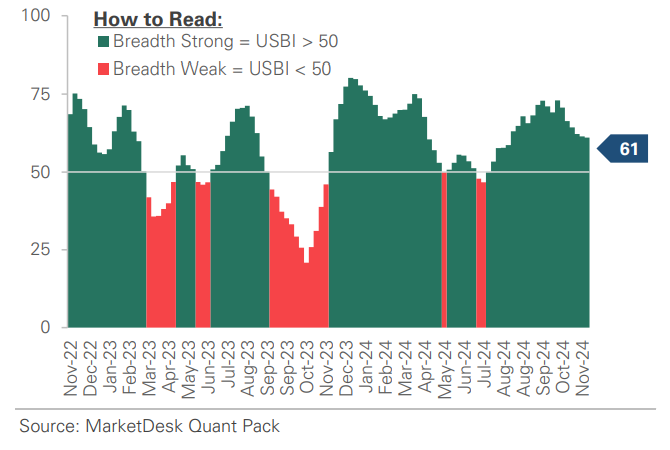

Our US Breadth Indicator (USBI) is at 61, down from a peak of 75 in mid-September. USBI is most effective as a barbell, with extremes signaling above-average returns and win rates. High USBI readings historically signal continued momentum. In these periods, the S&P 500 historically produces above-average returns with higher win rates over the next 3- and 6-month periods. Drawdowns also tend to be smaller when USBI is high, and markets tend to be less volatile. On the opposite end, low USBI readings often serve as a contrarian indicator. During these periods, market breadth tends to be so weak that it acts as a tailwind, such as after large selloffs. Like high readings, low USBI readings historically signal above-average returns and win rates over the next 3- and 6-month periods. With the recent decline from the low 70s to the mid-50s, breadth is changing from a momentum tailwind to a non-factor. Returns are not necessarily below average, but the potential for significant upside is more limited.

US Market Breadth Indicator

Deteriorating Market Liquidity = Risk of Bigger Drawdowns

Our US Net Liquidity Indicator (USNLI) stands at 47%. Historically, the primary risk with low USNLI readings is not necessarily below-average returns but increased return volatility. The equity market is more prone to large selloffs in low liquidity environments. Investors can still experience reasonable short-term gains during low liquidity periods, but the risk of a sharp drawdown is significantly higher.

Entering 3rd Year of Bull Market

The S&P 500 is entering the third year of a bull market that began in October 2022. In the first two years (Oct. 2022 to Oct. 2024), the S&P 500 returned a cumulative +61%. The chart below graphs the S&P 500’s cumulative return in the first two years of bull markets and shows the current bull market aligns closely with prior ones. There have been 15 bull markets since 1932, and the S&P 500 averaged a +61.9% return in the first two years. Year three can be a turning point. The chart below shows the S&P 500’s return in year three after the bull market starts, regardless of the bull market’s status. While this includes instances when the bull market had ended before year 3, it demonstrates the potential for dispersion. The average year three return is +4.6%, but the average hides underlying volatility. The win rate is only 60%, down from 93% and 100% in years 2 and 1, respectively. The takeaway: by year 3, it’s common to see a dropoff in returns.

Cumulative Bull Market Returns Through End of Year 2

Year 3 Returns Show Significant Return Dispersion

What Does This Mean for 2025?

The sections above make a case for below-average returns with increased selloff risk later in the year. The difficulty lies in timing the shift between these two phases. From our vantage point, 2025 looks challenging. However, today’s market is highly momentum-driven, like the 1950s and the 1990s. Those two decades showed that equity market strength can last longer than expected. It will be important to balance the potential for continued near-term momentum with the risk of below-average long-term returns. We will focus on the US Risk Demand Indicator (USRDI) and high-yield credit spreads to help navigate financial markets.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.