Fed Cuts Rates By Another -0.25%, But Lowers Expectations for 2025

Photo Credit: Eugene Zhyvchik, Unsplash

Weekly Market Recap for December 19th

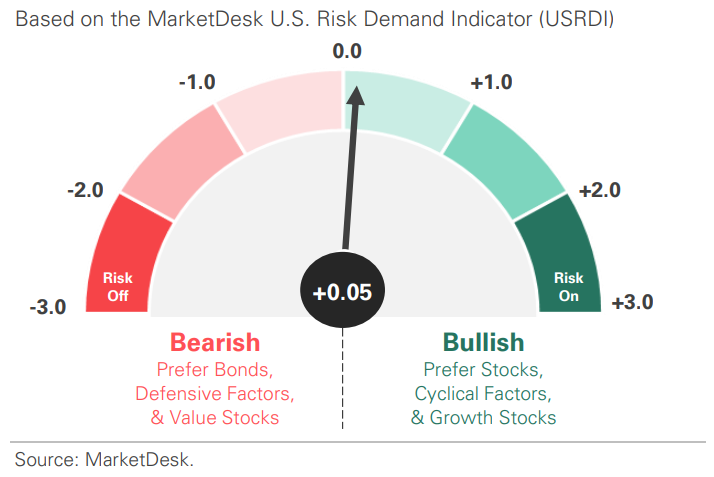

This week, Powell's press conference and the SEP triggered a cross-asset selloff. Stocks, bonds, crypto, and commodities all traded lower. Growth, Large, Momentum, and Low Volatility outperformed, while Small, High Beta, and Equal Weight underperformed. In the credit market, bonds traded lower as yields spiked, with Long Duration underperforming. In crypto, bitcoin plunged over -5%. Wednesday's selloff resembled a mini-August event, when markets fell as the yen carry trade blew up and investors deleveraged. We attribute this week's selloff to low realized volatility, which lulled investors into increasing their long exposure and led to crowded positioning. When realized volatility spiked after Wednesday's FOMC meeting, it prompted mechanical selling (i.e., investors set predetermined volatility targets, and higher volatility meant they had to decrease their equity exposure). Like August, we expect this selloff to be brief, although there could be aftershocks in the coming days.

S&P 500 Index (Last 12 Months)

S&P 500 Technical Composite (Last 24 Months)

US Bull and Bear Market Guage

Bullish Bearish Market Narrative

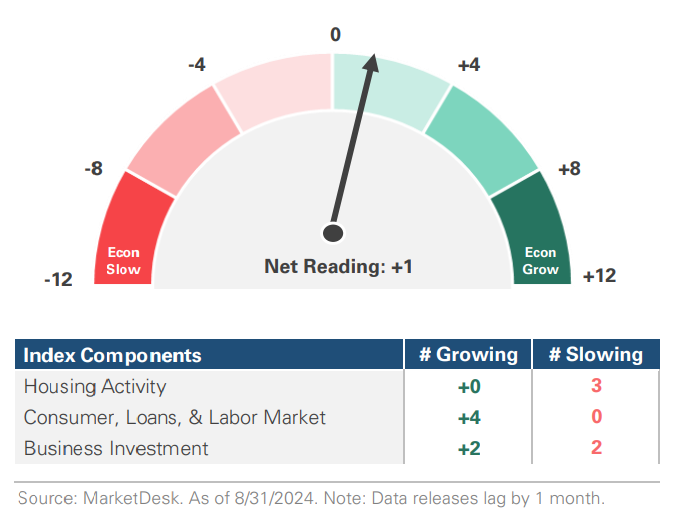

US Market Economic Cycle

December FOMC Meeting

The Fed cut interest rates by -0.25%, marking the third consecutive cut and lowering the Fed funds rate by -1.00% from its recent peak. However, Powell's press conference and the updated Summary of Economic Projections (SEP) were significant events. Chair Powell appears to have completely reversed his position, starting with the press conference. Earlier this year, the Fed shifted its focus to unemployment as inflation declined and unemployment rose, using the combination to justify September's -0.50% jumbo cut. This week, Powell shifted focus back to inflation, saying, "...as for additional cuts, we're going to be looking for further progress on inflation." Powell later added, "We have lowered our policy rate by a full percentage point from its peak and our policy stance is now significantly less restrictive. We can therefore be more cautious as we consider further adjustments." The updated SEP aligns with Powell's press conference, with the median fed funds projection for 2025 rising by +0.5% to 3.9% and the longer-run estimate rising another +0.1% to 3.0%. The Fed also raised its 2025 GDP estimate by +0.1% to 3.1%, lowered its unemployment forecast by -0.1% to 4.3%, and raised its Core PCE estimate by +0.3% to 2.5%. The message: expect fewer rate cuts in 2025. The market received the message and now places a 91% probability of no rate cut in January, with a greater than 50% probability of no rate cut in March. The scenario of seasonal inflation adjustments gives the impression that inflation is heading to target while labor market reentrants temporarily push up unemployment—only for both trends to reverse. It is common for the market to overestimate the need for rate cuts, and since the first rate cut, Treasury yields have risen, and bonds have sold off. Investors are rejecting Fed policy despite previously wanting rate cuts. If the back end of the yield curve continues to rise, it could create significant problems.

Federal Reserve Cuts Rates By Another -0.25%

Federal Reserve Continues to Raise its Neutral Rate Estimate

Consumer Spending Remains Strong

Retail sales rose +0.7% month-over-month in November, above expectations of +0.6%. This rise follows October’s upwardly revised +0.5%. Retail sales rose +0.2%, below the +0.4% estimate, excluding auto and gas. Motor vehicles and online sales led the increase, although there were signs of broad-based strength across other categories. The control group, which feeds into GDP calculations, increased by +0.4%, rebounding from October’s -0.1% decline. The data highlights the US consumer’s resilience. The labor market remains solid with low initial jobless claims, low unemployment, and continued wage growth. As Fed Chair Powell discussed in his press conference this week, the recent labor market improvement from August has allowed the Fed to refocus on inflation. Separately, household balance sheets remain strong, with record-high stock prices and high home values driving spending. This, along with locked-in interest rates and wage growth, allows the consumer to continue spending.

Group Control Retail Sales Rebound

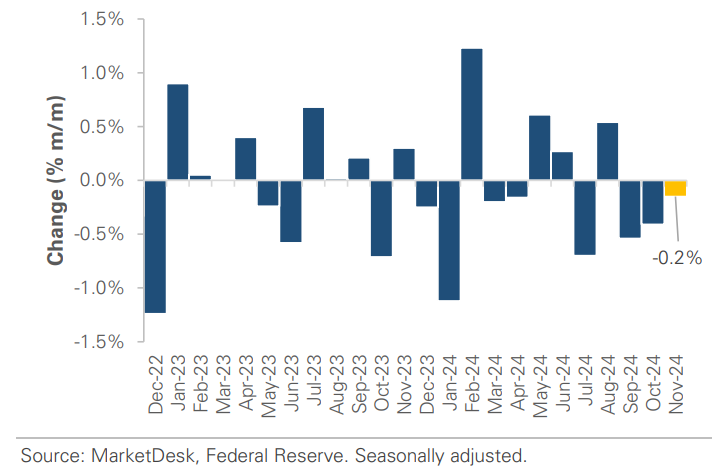

Industrial Production Contracts for Third Month

Manufacturing activity remained sluggish in November. Headline industrial production declined -0.1% month-over-month, below expectations of +0.35%. It was an improvement from October’s -0.4% drop, which was affected by the Boeing strike and hurricanes, but it marked the third straight monthly decline and the fourth negative print in five months. Within industrial production, the manufacturing subindex posted a disappointing +0.2% gain after October’s downwardly revised -0.7%. Manufacturing remains in an extended downturn, with high borrowing costs and uncertainty about tariffs likely weighing on business investment. The best-case scenario is that activity picks up in the coming months as the Fed cuts interest rates and the Trump administration provides more details around tariffs. If not, sustained weakness could affect economic activity and lead to slower GDP growth.

Industrial Production Declines for 3rd Straight Month

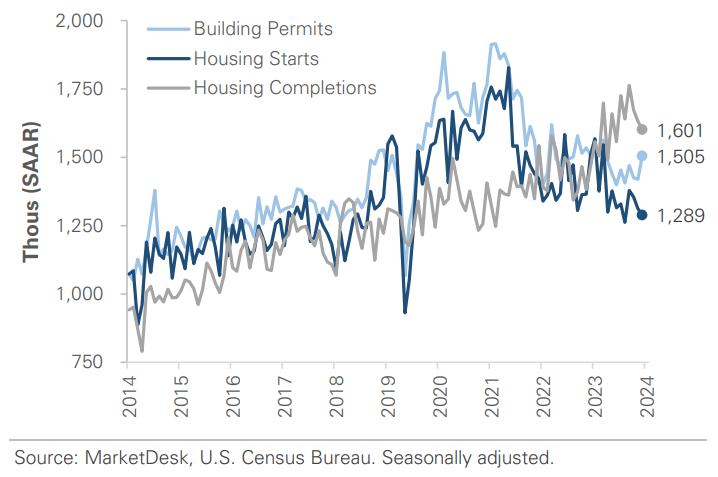

Housing Activity Continues to Slow

Housing starts fell to a 4-month low in November despite a surge in the South as parts of the area rebounded from hurricane-related delays. While starts declined, building permits rose to the highest since February, with broad strength across regions. The chart below shows that both starts and permits remain significantly below their COVID peaks as housing activity slows, resulting in a prolonged downturn. The slowdown is concerning, but it’s important to note that the pace of starts and permits remains high compared to the 2010s. Housing completions are running at the highest pace since 2007, and the big picture is unchanged. Housing activity surged in 2021 and early 2022 as interest rates dropped to near 0%, but it has since cooled. The encouraging development is that the cooling pace has been primarily orderly compared to past episodes, such as the lead-up to the 2008 financial crisis. The second chart below shows the slowdown has been most pronounced in multi-family starts, which are near a decade-low. In contrast, single-family starts have recently been running above the pre-pandemic trend. Housing is slowing, but thus far, it is more normalization than decline.

Housing Activity Continues to Slow

Housing Starts - Single vs Multi-Family

Looking Ahead

This week’s economic data highlights the state of the US economy: the consumer is resilient, while business investment and housing remain weak. It is early in the rate-cutting cycle, but they have had little impact so far. Looking ahead to early 2025, we want to see evidence that interest rate cuts are stimulating housing and business investment. If the current trend continues and rate cuts have little impact, it raises the potential for an economic slowdown. The size and speed of the slowdown would then become very important. Early 2025 data will provide crucial insight into the trajectory of any potential slowdown: shallow like 1990 and 2000 or deeper like 2007.

Fed Rate-Cutting Cycle Index

Rate-Cutting Cycles Lead to a Wide Range of Potential Economic Outcomes

Historical S&P 500 Performance Following the 1st Rate Cut

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.