Recession Fears Fade on Strong Labor Market Data

Photo Credit: Matthew Henry, Unsplash

Weekly Market Recap for October 11

Stocks ended the week slightly higher, with Large Cap Growth leading while Equal-Weight, Value, and Small underperformed. The top-performing sector was Technology, as Nvidia gained +7%, while Utilities and Real Estate gave back recent gains as yields continued to rise. Bonds traded lower as yields rose, with longer-duration bonds underperforming. The recent spike in yields has been fast and aggressive, and bonds are now broadly oversold. A near-term relief rally is possible, but we remain neutral for duration and continue to view bonds as expensive due to the economic backdrop and the probability of fewer rate cuts. Market sentiment is volatile, with no clear direction as investors rotate back and forth between mega-cap growth stocks and this year's underperformers.

S&P 500 Index (Last 12 Months)

S&P 500 Technical Composite (Last 24 Months)

Labor Market Continues to Improve

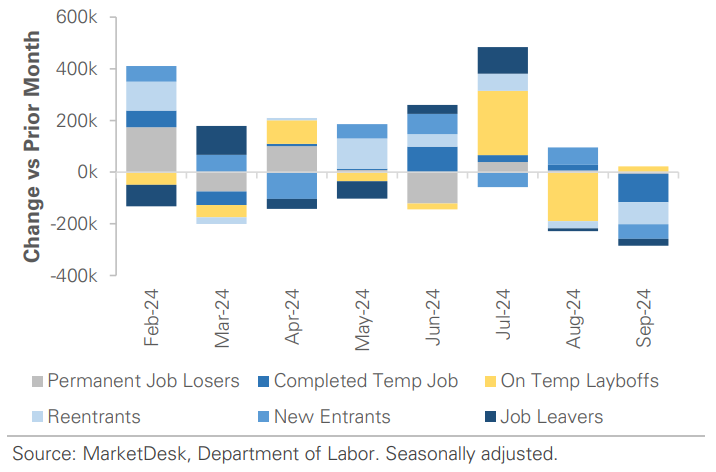

Unemployment fell by another -0.1% to 4.1%, and nonfarm payrolls rose by +254,000. This marks the second consecutive month of improving labor market conditions. Unemployment declined across age groups and genders, and initial jobless claims continued to retreat from their summer peak. Average monthly job gains remain strong at +175,000, a solid figure by historical standards. The market spent most of the past 6 months worrying about the labor market, but this report should alleviate some of the concern. Nearly 65% of the rise in unemployment was due to reentrants and new entrants, with temporary job completions accounting for 22% and permanent job losses contributing only 19%. The data indicated the labor market's main issue was an increase in supply rather than weaker demand. This thesis is supported by the fact that the drop in unemployment was due to reentrants/new entrants finding jobs and fewer individuals being on temporary layoffs. While there are reasons to be cautious, data suggests that the risk of unemployment surging to 6% is diminishing. Our view is unchanged: the labor market is finding a new equilibrium rather than deteriorating. Jobless claims jumped to a 12-month high this week, but the rise is distorted by auto worker strikes and hurricanes Helene/Milton, making them noisy and unreliable near-term.

Unemployment Falls to 4.1% in September

Job Growth is Still Strong by Historical Standards

Reason for Unemployment

Headline Inflation Eases, but Core Remains Sticky

Headline CPI rose by +0.2% in September, matching the last two months. Year-over-year, CPI rose by +2.4%, the slowest rate since February 2021. The decline in inflation is due to slowing inflation in food, energy, and goods. Food and Energy inflation is significantly below 2022 levels, and goods deflation remains a tailwind, with prices for both Commodities Ex-Food and Energy and New and Used Vehicles relatively stable. Despite declining headline CPI, inflation pressures persist, with core CPI rising by +0.3% for the second consecutive month. This marks a notable change from the summer when Core CPI increased by only +0.1% in June. Core CPI rose by +3.3% in September year-over-year, indicating progress stalled the past four months. Some of this lack of progress is due to inflation's seasonality. However, there are still significant inflation pressures underneath the surface. Core Services (ex-Shelter) rose by +0.6%, up from +0.1% in August and the fastest pace since March.

Monthly Changes Across CPI Categories

Headline CPI Declines, While Core CPI Remains Sticky

The Fed’s Next Step

The Fed justified its -0.50% rate cut by pointing to easing inflation and rising unemployment, but recent data suggests there's less need for aggressive cuts. The Fed should continue cutting, but as we have discussed all year, it does not need to cut as deep as the market expects. In recent months, we have discussed our view that the economy is in better shape than the Fed and investors believe. Neither the Fed nor the market seems to acknowledge that the economy has changed, which is not a typical business cycle. As a result, the market will remain highly narrative-driven. For instance, the US 10-year Treasury yield has risen nearly +0.50% since the Fed cut rates. Navigating these narratives will require a strong focus on data and a willingness to push back against the narrative.

Look Ahead to Next Week

Next week’s economic calendar includes multiple hard data points, providing another opportunity to see how the economy is performing. Key recent economic releases included:

ISM Mfg PMI

Actual: 47.2

Consensus: 47.6

Prior: 47.2

ISM Services PMI

Actual: 54.9

Consensus: 51.7

Prior: 51.5

Construction Spending

Actual: -0.1%

Consensus: +0.1%

Prior -0.47%

Commentary: No change. Private remains weak, particularly residential & commercial, while government set a new all-time high.

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.