The Fed Kicks Off the Rate-Cutting Cycle

Photo Credit: Mark Duffel, Unsplash

Weekly Market Recap for September 20th

Stocks rose this week, with the S&P 500 hitting a new all-time high. However, Small’s relative strength stood out, outperforming Large by over 3%. High Beta and Equal Weight outperformed the S&P 500, while Low Volatility lagged during the market rally. Energy led all sectors, with oil prices rising nearly 5%. Cyclical sectors followed closely, with Industrials, Materials, Consumer Discretionary, and Financials each gaining more than +3%. In contrast, defensive sectors underperformed after recent gains tied to rate-cut expectations. Notably, in the bond market, high-yield bonds outperformed, while long-duration Treasury bonds underperformed.

S&P 500 Index (Last 12 Months)

S&P 500 Technical Composite (Last 24 Months)

Fed Kicks Off Rate-Cutting Cycle

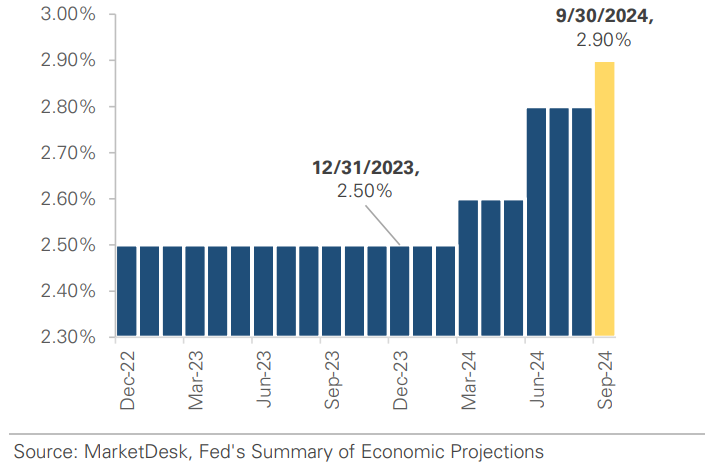

The Fed cut interest rates by -0.50% at this week’s FOMC meeting. The main question wasn’t whether the central bank would cut rates but by how much. The debate between a -0.25% and a -0.50% cut dominated headlines over the past week, but it was mostly noise and won’t have a significant long-term impact. Now that the first cut is complete, the focus shifts to how much and how quickly the Fed will continue to cut rates. Chair Powell offered little guidance, describing the outsized rate cut as a recalibration. The Fed’s Summary of Economic Projections (SEP) provides more insight into its current thinking, particularly the median estimate of the longer-run Fed funds rate. This estimate serves as a proxy for the neutral rate, the theoretical interest rate that neither stimulates nor restricts the economy. Officials previously estimated the neutral rate at 2.5%, but this year, the median estimate has risen from 2.5% in January to 2.9% in September. It has increased at each of the past three meetings. The Fed is signaling investors that it believes the neutral rate is higher than before the pandemic. This has significant implications, as Chair Powell has repeatedly expressed a desire to return to neutral.

Fed Kicks Off Rate-Cutting Cycle with a -0.50% Cut

But where exactly is the neutral rate?

Powell addressed this in his press conference by stating "... many people, anyway, would say we’re probably not going back to that era where there were trillions of dollars of sovereign bonds trading at negative rates ... It seems that’s so far away now. My own sense is that we’re not going back to that but, you know, honestly, we’re going to find out. But, you know, it feels—it feels, to me, that the neutral rate is probably significantly higher than it was back then. How high is it? I don’t — I just don’t think we know. Again, we only know it by its works. "

The Fed Continues to Raise Neutral Rate Estimate

The Fed & The Market Disagree on the Path Forward

What does this all mean? The Fed’s Summary of Economic Projections (SEP) shows the estimated neutral rate is 2.9%. The Fed’s projections show it expects to end 2025 at 3.4%, which would still be +0.5% above the neutral rate. The Fed doesn’t expect to reach 2.9%, or neutral, until the end of 2026. For comparison, Fed funds futures show that investors expect the Fed to reach 2.9% by November 2025, a full 12 months ahead of the Fed’s projections. The Fed and Chair Powell are signaling a slow and methodical rate-cutting cycle as they try to find the new neutral rate, but investors expect a quick and aggressive cycle. There’s a fundamental disagreement between the Fed and markets about how to approach the rate-cutting cycle. It is too early to tell which side is more accurate until we see more data, but it is important to understand where expectations currently sit.

Markets will be Hyper-Sensitive to Economic Data over the Next Six Months

Both the Fed and investors are guessing about the neutral rate. As discussed in the 3/15/24 Strategy Snapshot, the economy's trajectory will determine how much and how fast the Fed cuts. A recession or sharp slowdown will lead to more and deeper cuts, while a growing economy will lead to fewer and slower cuts. Economic data will become more important in the coming months, and the market will likely overreact to each data point until a trend emerges. Within six months, the data should provide evidence that either rate cuts are stimulating the economy or the lag of monetary policy is slowing the economy.

Look Ahead to Next Week

The economic calendar slows next week, with the two big reports being the final Q2 GDP estimate and durable goods orders. This week's economic releases for consumer spending, manufacturing activity, and housing mostly surpassed expectations:

Retail Sales

Actual: +0.1%

Consensus: -0.2%

Prior: +1.1%

Commentary: Spending at online retailers offset broad weakness; control group, which feed into GDP, rose for 4th consecutive month

Industrial Production

Actual: +0.8%

Consensus: +0.15%

Prior: -0.9%

Commentary: Big rebound after hurricane disruptions in July; manufacturing ex-autos rose after two monthly declines.

Housing Starts & Building Permits

Commentary: Starts & permits rise to highest levels since spring 2024.

Starts

Actual: 1,356k

Prior: 1,237k

Permits

Actual: 1,475k

Prior: 1,406k

Important Disclosures

This material is provided for general and educational purposes only and is not investment advice. Your investments should correspond to your financial needs, goals, and risk tolerance. Please consult an investment professional before making any investment or financial decisions or purchasing any financial, securities, or investment-related service or product, including any investment product or service described in these materials.